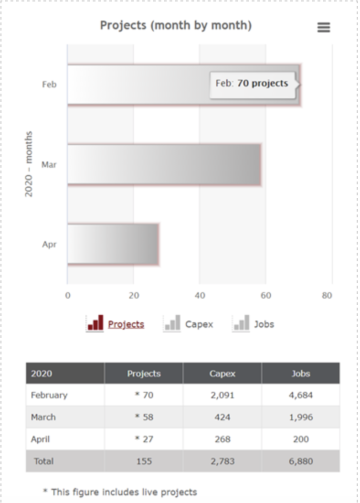

Data from FDI Markets on the industrial market breaks down various initiatives planned throughout the industry in February, March, and April 2020. The statistics cover projects in the automotive, aerospace, medical devices, electrical components, industrial machinery, transportation, and energy markets. Not surprisingly, the data shows a significant downward trend month to month as the coronavirus worsened. In February, 70 projects had been announced; that number fell to 58 in March and 27 in April. Capital expenditures fell from just over $2 billion in February to $424 million in March and $268 million in April.

Cash is king in a recession, and many companies want to hold on to some of their money or avoid making project announcements until there is clarity in the market. As a result, capital expenditures and projects declined. Additionally, as the virus has disrupted trade and the movement of goods and people, companies have been forced to start rethinking how their supply chains are organized. Many are likely reevaluating their plans and reorganizing them to be more agile, resilient and sustainable.

A recent survey by the Site Selectors Guild and place marketing firm Development Counsellors International provides extra insight on the FDI Markets data. Respondents anticipate that North America will likely benefit from companies rethinking their supply chains, “particularly in the pharmaceuticals and life sciences sectors.” The survey also identifies several important impacts to the industry post-coronavirus such as which sectors will be hottest, the effects of widespread remote working, and more. To read the survey results and analysis, click here.

Investment announcements didn’t completely stop, however, because some companies still need to prepare for new product or model launches that will happen months or years from now. Starting to design, test, and build production lines for those launches is important and takes time. While there is less investment, it hasn’t completely dried up, and opportunities still exist. The key for manufacturing suppliers is to prove how they can add value and resiliency to their partners upstream.

For additional information on new investments, SalesLeads’ industrial market research team has conducted their own research into industrial manufacturing projects for March. That report is focused on industrial manufacturing – not on all the categories discussed here. The difference in sources means the data looks different, and they include an in-depth look at their top ten tracked industrial manufacturing projects. That report can be accessed here.