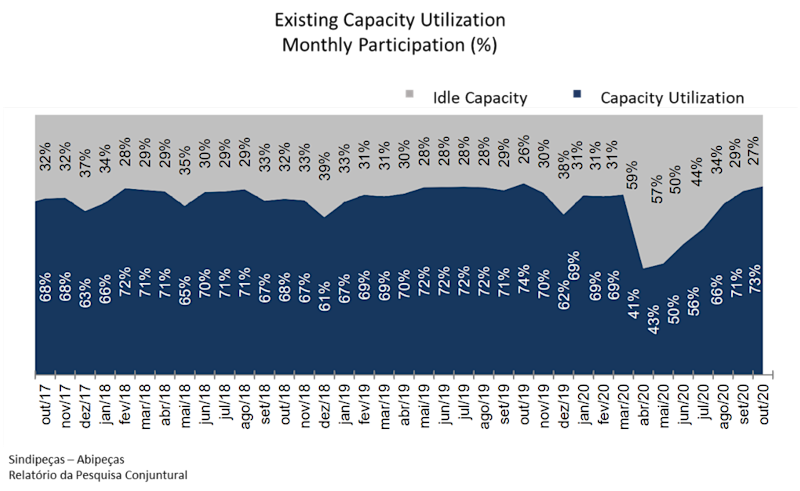

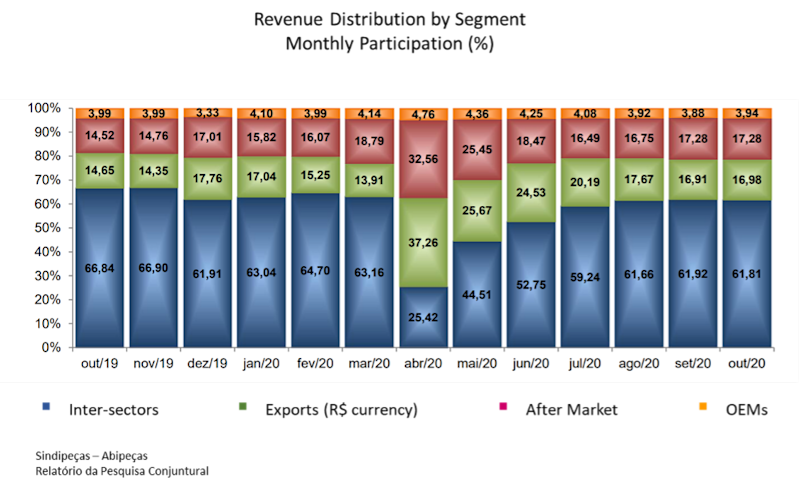

In June 2020, the Brazilian auto manufacturing market plunged 58%, continuing its downward trajectory that had begun due to the COVID-19 pandemic (Calmon, 2020). At the time, ANFAVEA predicted the market would not recover before 2025 (ETAuto.com, 2020). This translated to a marked decrease in both import and export of auto parts, constituting a 34% decrease in exports and a 28% decrease in imports, year-over-year (Sindipeças, 2020). While it is too soon to determine whether manufacturers will shift the supply chain away from Brazil, it should be noted that the Brazilian auto market was already noting a slow contraction before the pandemic.

Brazil’s Supply Chain Operational Shifts

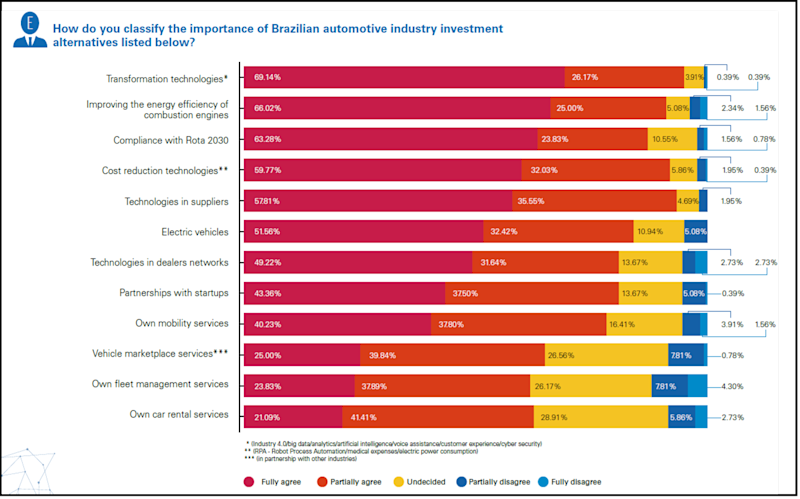

In a 2019 KPMG survey of 256 executives from various parts of the Brazilian auto manufacturing supply chain, the vast majority indicated that adopting compliance with Rota 2030, transformational technologies, and cost-reduction technologies in auto manufacturing and value chain were high priorities (Bacellar & Stefani, 2020):

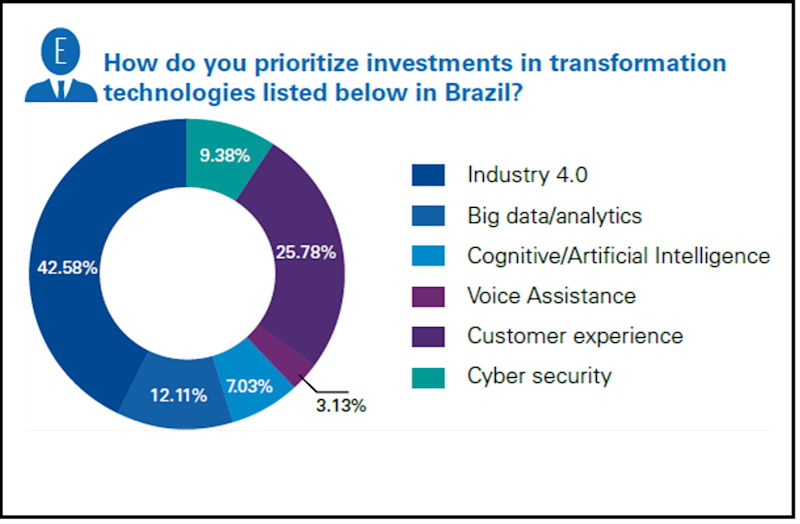

Of the executives surveyed who prioritized transformational technologies, over 42% were already making Industry 4.0 investments for the future of the Brazilian auto industry before the pandemic. With regards to cost reduction technologies, an overwhelming majority of executives surveyed prioritized robot process automation (RPA) as a future investment trend in Brazilian vehicle production as seen in the figures below (Bacellar & Stefani, 2020):

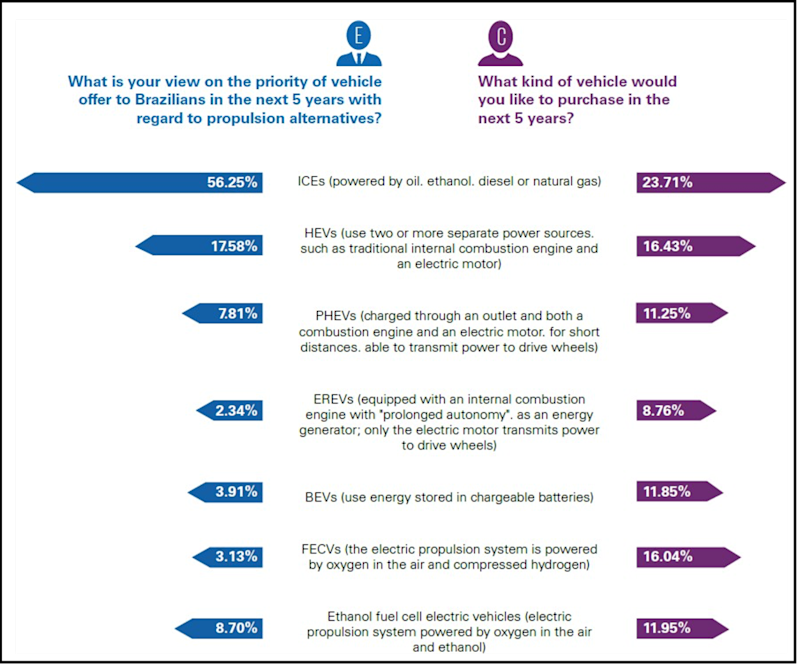

KPMG detected differing opinions between the 256 executives and 1,004 consumers surveyed, noting that while 90% of consumers were interested in purchasing electric vehicles (EV), less than half of executives anticipated the market favoring EV in the short-term. An analysis of both executive prediction and consumer preference of propulsion alternatives in future vehicle production can be found below (Bacellar & Stefani, 2020):

The recently announced decision of Ford Brazil to close their operations in the country adds to the uncertainty about growth and sustainability of the Brazilian automotive industry. Nevertheless, all other automotive OEMs immediately pledged to fill the gap quickly with their own products and increase their market share.

The information provided in this article is based on research and report provided by George Washington University – CIBER Bootcamp and commissioned by IBDGi on behalf of AMT.

References

Calmon, F. (2020, July 14). Brazilian June production plunges 58%. Retrieved August 12, 2020, from https://www.just-auto.com/news/brazilian-june-production-plunges-58_id196628.aspx.

Bacellar, R., & Stefani, M. (2020). KPMG Global Automotive Executive Survey 2019. Retrieved August 12, 2020, from https://automotive-institute.kpmg.de/GAES2020/.

ETAuto.com. (2020, July 4). Italy to introduce subsidies to combustion engine cars to help industry. ETAuto.com. Retrieved from https://auto.economictimes.indiatimes.com/news/policy/italy-to-introduce-subsidies-to-combustion-engine-cars-to-help-industry/76779338.

Sindipeças. (2020). Relatório da Balança Comercial de Autopeças. Retrieved from https://www.sindipecas.org.br/sindinews/Economia/2020/BCA_JUL20.pdf.