The two best places to build a deep understanding of the manufacturing technology eco-system are IMTS and EMO. These past couple weeks, EMO has been the center of the manufacturing world as innovators, builders, customers, investors, and enthusiasts converged on Hannover. The mood was one of concern and astonishment. The concern stemmed from the numerous challenges there are to growth. The trade wars—particularly the China-U.S. issue, where the ongoing institution of tariffs have prevailed for more than a year—have led to some multi-national companies changing their international strategies. The Brexit situation was almost as common an issue as the trade wars. Billions of dollars of investments will be impacted as EU and non-EU companies’ strategies for supplying EU demand are turned on their heads.

Still, members felt upbeat and positive about the audience in attendance, the projects discussed, and the innovations displayed. While crowds were lighter than in past shows, attendees from every industry engaged exhibitors in discussion on current projects. The most heartening news came from the interest shown in new equipment by the automotive supply chain as automotive orders throughout the year have been weak according to reports and discussions with AMT’s global counterparts.

Each year, AMT meets with 25 other metalworking equipment associations from around the world at EMO and IMTS. As with previous years, the presidents of the associations reported on market developments over the past year and expectations for the current and coming years—2019 and 2020. The global manufacturing technology market was very strong in 2018, so a cooling of the market could have been expected. Markets in 2019 are expected to fall between 4 and 28 percent, with two exceptions. Russia expects its manufacturing technology market to climb 2 percent in 2019, and the Indian machine tool association is projecting a 5 percent increase. Expectations among the 25 nations represented were split: 40 percent expected their markets to improve, 40 percent expected their markets to continue to decline, and 20 percent expected their markets to remain at 2019 levels.

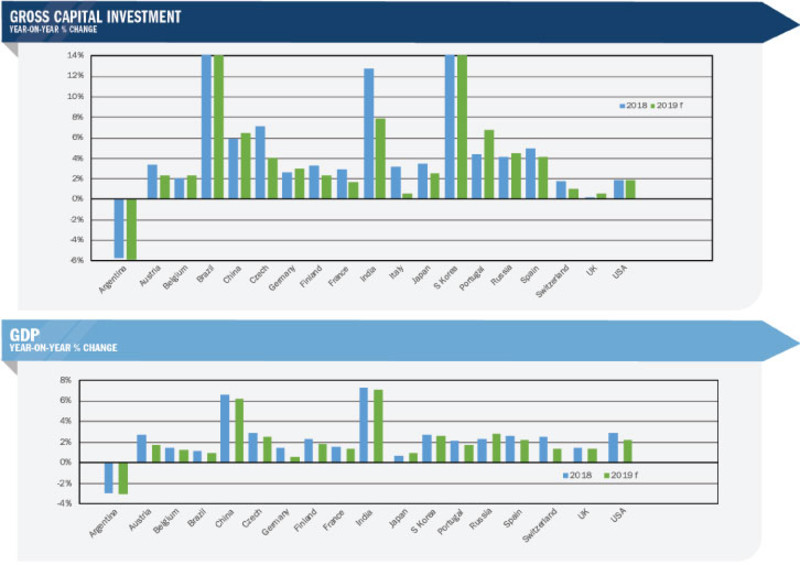

The forecasts for the metalworking markets were supported by positive numbers on trends in investment and GDP growth rates. The associations shared positive forecasts for investment spending in 2019, with most expecting investment growth surpassing 4 percent and the average rate topping 2 percent. The industrial production forecasts were not as encouraging as they fell well short of 2 percent on average. During the open discussions among the statistical general managers, there was a general concern over whether China or the United States would meet their 2020 growth expectations given the intensifying trade issues.

One example of the strategic decisions that the situation has led to included Emerson’s March announcement that they were bringing their garbage disposal production back to the United States from China. Several of the Asian managers shared similar stories, including an Aug. 5 set of announcements noting companies were moving plants home or to other nations. Asics has been relocating their athletic shoe plant from China to Vietnam. Ricoh announced they were moving their plant from Shenzhen to Thailand. Others chimed in that Nike and Adidas had already made similar moves.

I think many people heading to Hannover were looking to walk into doom and gloom. While it was wet and cold the first day, the weather and the mood greatly improved throughout the rest of the week. All in all, Die Welt ist Gut - the world is good.