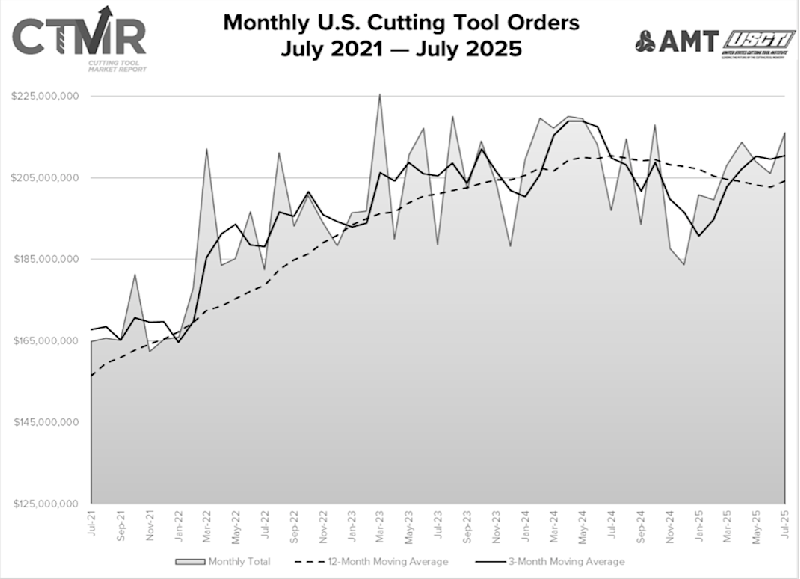

McLean, Va. (September 23, 2025) — Shipments of cutting tools, measured by the Cutting Tool Market Report, a collaboration between AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI), totaled $216.2 million in July 2025. Orders increased 4.9% from June 2025 and 9.8% from July 2024. Year-to-date shipments totaled $1.45 billion, down 2.9% from the same period in 2024.

“The latest trend is showing some modest growth compared to the previous months, which coincides with the activity of most shops,” said Jack Burley, chairman of AMT’s Cutting Tool Product Group. “They still have orders to fill and are not indicating any signs of slowing down. However, areas of concern remain for automotive, construction, and agricultural companies, where sales and tariffs are hitting hardest, causing delays for investment. More importantly, the tariff costs are settling in for most of the imported tools and raw materials, which may be stabilizing prices for now.”

Eli Lustgarten, president of ESL Consultants, said:

“Current data suggests that the worst is over for the cutting tool sector, but businesses appear to be adopting a wait-and-see attitude. The outlook seems relatively flat, with a positive bias for the second half of the year and into 2026. End-market demand, which had been driven by aerospace, automotive, and heavy equipment, can now count only on the aerospace sector. The auto sector faces supply chain issues related to trade as well as the expiration of the EV incentives. Slower domestic economic growth and the effect of inflation on consumers indicate a slowing of auto production. The heavy equipment market appears flat, with possible positive trends in the construction sector because of reduced inventories, a slight pickup in trucks, and a possible improvement in mining. However, the outlook for the agricultural sector continues to deteriorate because of record yields and crops, rising carryovers, and declining prices, which have translated into a new round of layoffs.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process, the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, AMT acts as the industry’s voice to accelerate the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and market intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. Learn more at AMTonline.org.

The United States Cutting Tool Institute (USCTI) was formed in 1988 and resulted from a merger of the two national associations representing the cutting tool manufacturing industry. USCTI works to represent, promote, and expand the U.S. cutting tool industry and to promote the benefits of buying American-made cutting tools manufactured by its members. The Institute recently expanded its by-laws to include any North American manufacturer and/or remanufacturer of cutting tools, as well as post-fabrication tool surface treatment providers. Members, which number over 80, belong to seven product divisions: Carbide Tooling, Drill & Reamer, Milling Cutter, PCD & PCBN, Tap & Die, Tool Holder and All Other Tooling. A wide range of activities includes a comprehensive statistics program, human resources surveys and forums, development of product specifications and standards, and semi-annual meetings to share ideas and receive information on key industry trends.

# # #