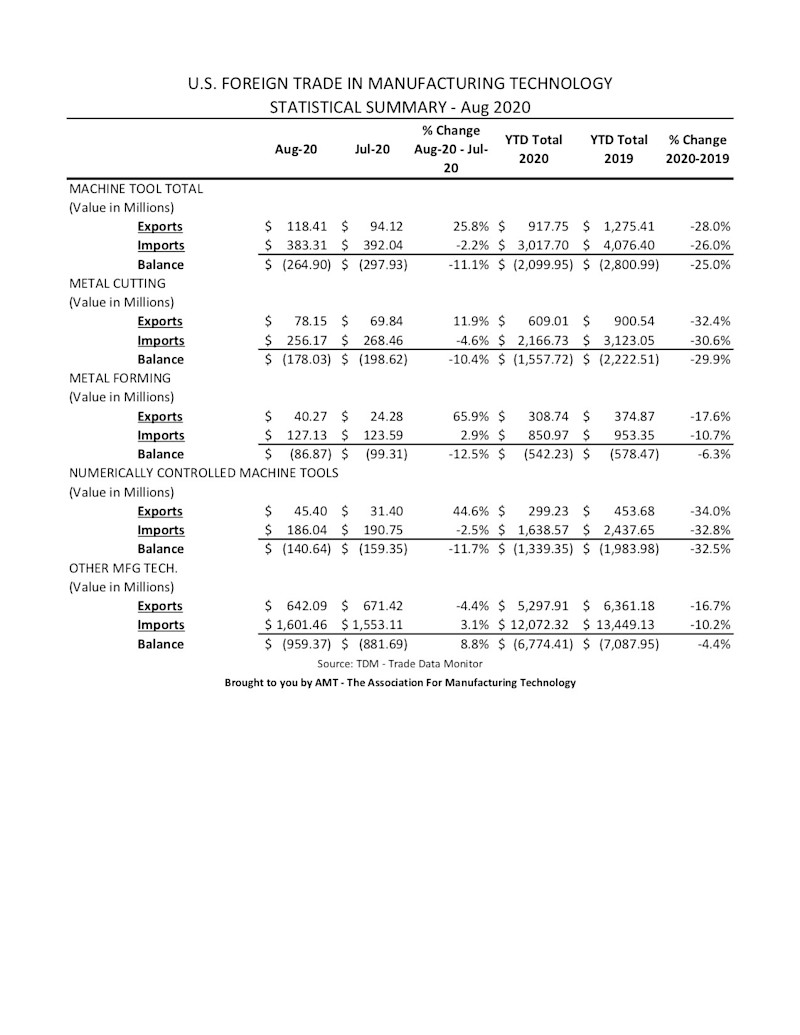

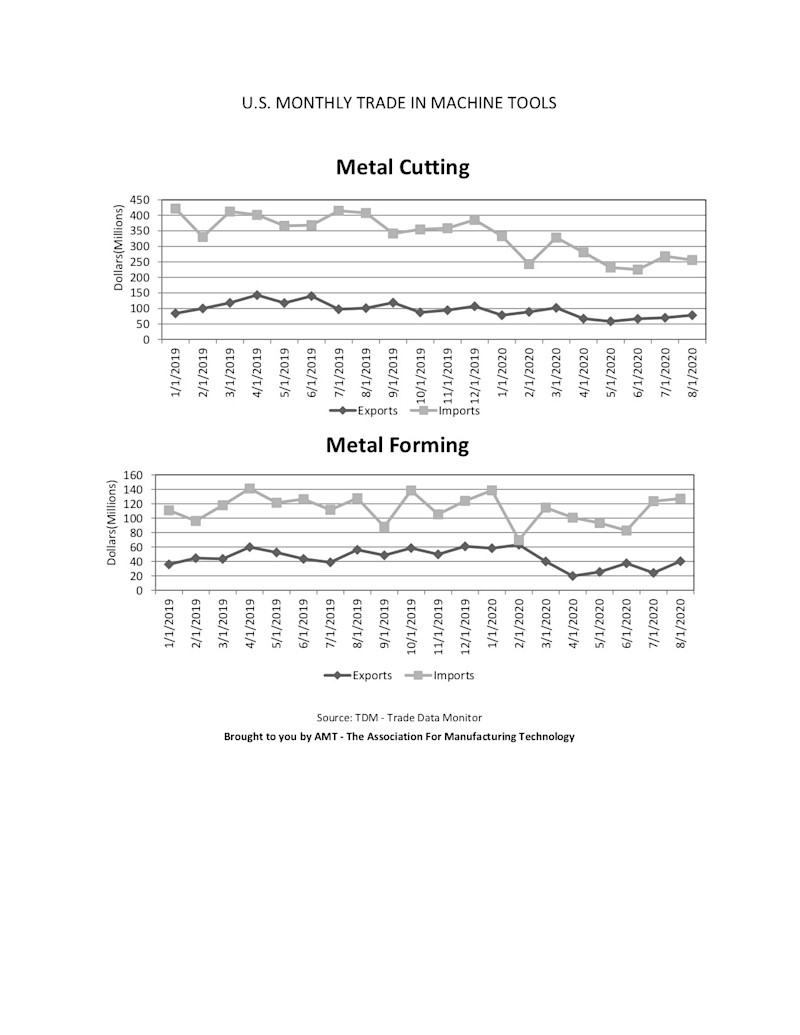

U.S. machine tool exports valued $118.41 million in August, up 25.8% from July’s total of $94.12 million. Exports for year-to-date 2020 totaled $917.75 million, a decrease of 28.0% when compared to the same period for 2019. Monthly machine tool imports valued $383.31 million in August, down 2.2% from July’s total of $392.04 million. Imports for year-to-date 2020 totaled $3,017.70 million, a decrease of 26.0% when compared to the same period for 2019.

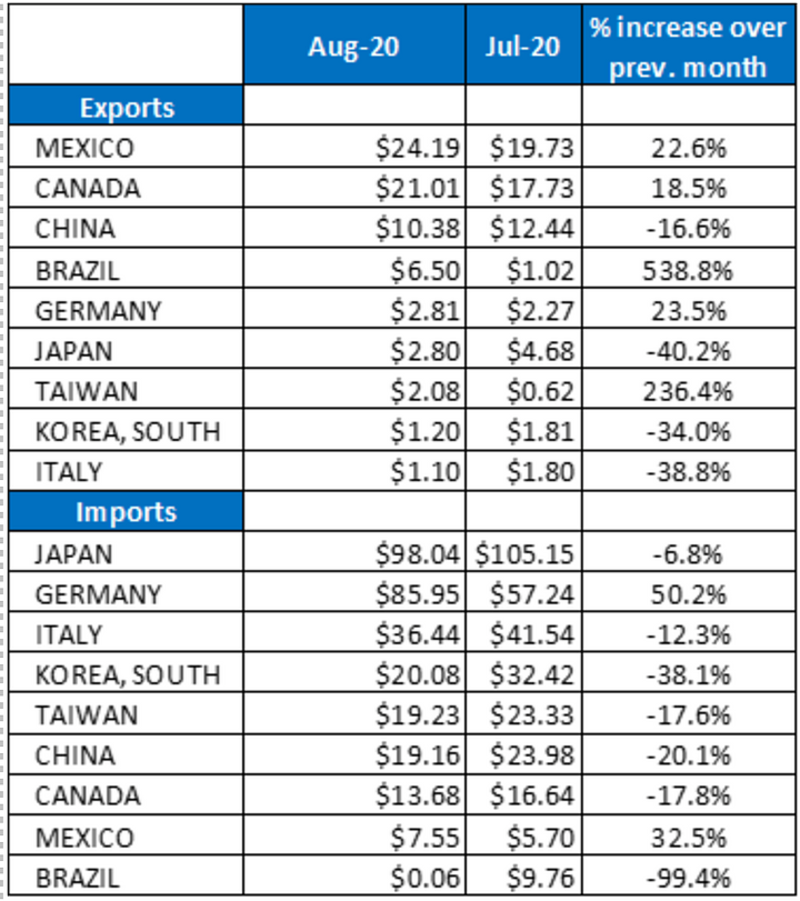

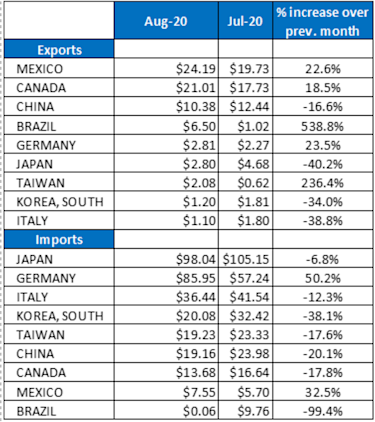

Mexico was the leading destination for U.S. machine tool exports in August, with $24.19 million, a 22.6% increase from July. The second largest destination for U.S. machine tool exports was Canada, $21.01 million, an 18.5% increase from July. Completing the top five destinations for U.S. machine tool exports were China ($10.38 million), Brazil ($6.50 million), and Germany ($2.81 million).

Japan ($98.04 million) and Germany ($85.95 million) were the top suppliers of U.S. machine tool imports for August. Compared to July’s figures, Japanese imports decreased 6.8% and German imports increased 50.2%. Completing the top five sources of U.S. machine tool imports in August were Italy ($36.44 million), South Korea ($20.08 million), and Taiwan ($19.23 million).

For more information about any aspect of this report or to make a specific data request, contact Jonathan Nguyen at jnguyen@AMTonline.org or 703-827-5268.