It’s fall in an odd year, which tends to turn manufacturing technology geeks’ attention toward Europe in anticipation of EMO. This year, Europe’s largest manufacturing technology show was held in Milan. The event, similar to IMTS, offers the opportunity for industry leaders and analysts to compare notes and share insights into the past year’s market activities and where they’re likely headed in 2022 and beyond.

A meeting of minds

Manufacturing technology association chief executives from nearly three dozen countries have made it a tradition to meet and discuss global and national trends that influence our industry’s markets and technological evolution at IMTS, EMO, and the China International Machine Tool Show. This year is only different in that many of those associations are not represented due to travel restrictions, but the sharing has continued. The good news from the aggregate data is that every country’s market has improved in 2021, and that trend is expected to continue into 2022.

Orders and shipments on the mend

Despite the good news, there is some significant variation in the magnitude of growth rates. France, which was the hardest-hit manufacturing technology market in world, saw Q2 2020 orders fall to 6% of the order level from Q2 2019. Order levels in Q2 2021 were nearly 30 times larger than in 2020 but still 40% less than a typical year. Italy’s market fluctuations were not as dramatic, but Q2 2021 orders were 4 1/2 times larger than the same period a year earlier. As the accompanying graph shows, the expansion in orders through the first two quarters of 2021 for most of the major economies were 30%-45% greater than the same period in 2020.

The growth rates in shipments are not as dramatic. First, the pandemic did not impact production rates as significantly as order rates, so shipment levels have a smaller gap to fill to return to early 2020 shipment levels. Second, supply chain issues are a global challenge, not just one for U.S. manufacturers. Manufacturers around the world drove their materials and component suppliers toward the lowest cost producer without the proper attention to managing supply chain risks. As panic subsided, orders rose rapidly, but supply chains’ ability to respond was not as resilient as the production lines closest to the consumer.

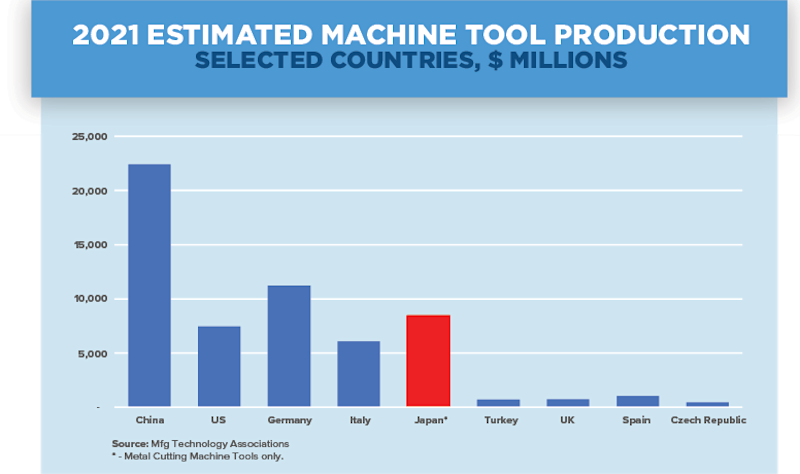

Domestic production and national economic growth

Bottlenecks developed in the early parts of 2021 for producers in all 13 countries participating in the data exchange. The 13 associations, including AMT, do not see that returning to normal soon. Some supply issues are beginning to dissipate, while others appear to be several quarters away from normalcy. Expectations among the major machine-tool-producing nations are that import growth in 2021 will be slower than both their domestic production and consumption growth rates. The upside is that domestic product will grow as a percentage of manufacturing technology consumption, but the downside is that slower improvements in trade will limit growth in the nations’ manufacturing expansions.

Still, the challenges that the manufacturing technology recovery have had in all our data-exchange partners’ countries have not dampened their positive outlooks for manufacturing or the national economies in general. Germany and Japan are both expecting 3.7% real growth in their economies and 9.6% and 13.4% growth respectively in industrial production levels during 2021. China is projecting a 6.0% growth in their real GDP, and AMT is expecting our economy to grow by 5.5%, with a 6.6% expansion in gross capital investment. Expectations in the EU countries for interest rates are for 0% to possibly -0.1%. The United States, UK, and Asian countries expect primary interest rates to remain between 0% to 0.5%

The key takeaway from the exchange is that all nations are experiencing growth in their manufacturing technology markets and expect continued growth into 2022.

“The upside is that domestic product will grow as a percentage of manufacturing technology consumption, but the downside is that slower improvements in trade will limit growth in the nations’ manufacturing expansions.”