July 1 saw the implementation of the new NAFTA, NAFTA 2.0, or as our government calls it, the United States-Mexico-Canada Agreement (USMCA). Ambassador Robert Lighthizer, the U.S. Trade Representative, called the implementation of the USMCA “the beginning of a new and better chapter for trade between the United States, Mexico and Canada.” It is better if the stronger worker protections, expansion of access promised, and increased North American content required to be tariff-free actually come to pass. The concern about that possibility rests with a number of new measures in the agreement that have not been tested and are significantly different or didn’t exist in NAFTA. These new measures are meant to address the dispute settlement process, address labor violations, and implement rules of origin changes.

For those in the manufacturing technology sector, the changes in the rules of origin will have a modest impact. Most manufacturing technology equipment will continue under the same rules of origin as set forth in NAFTA. There are exceptions, such as in the case of waterjet cutting machines, which were in a catch-all category. They now have a specific HS code, 8456.90, for which the rule consists of three parts, depending on the origin of components for the machine or a regional value of content formula. However, changes in the rules of origin for many consumers of manufacturing technology – particularly in the auto industry – could mean significantly more manufacturing and assembly activity in North America. Increased manufacturing levels will certainly lead to an expansion of the manufacturing technology market.

Everyone should check on the rules of origin for their products and that their products still qualify under the new agreement. You can find the current rules of origin on the USTR website in chapter four of the USMCA agreement. If you have a problem, please contact Chris Downs (cmdowns@AMTonline.org) or Pat McGibbon (pmcgibbon@AMTonline.org). AMT cannot make customs determinations for your products, but we can get you the correct source documents, share our advice on a likely determination, and point you toward the right spot inside U.S. Customs and Border Patrol to get a determination. Most freight forwarders have expert staff to help you with this issue as well.

The new USMCA has added a set of rules for remanufactured products preventing our North American partners from enacting legislation that would prevent the export of remanufactured products to these markets. In the past, NAFTA partners have passed laws forbidding the import of used machines, even if the machine had been completely remanufactured from the base up. The new agreement defines what is used or rebuilt versus what is remanufactured machinery.

Finally, the information required for filing a product as USMCA-qualifying has changed, but the governments do not have an official form. You are permitted, for the time being, to create your own form, which must include the following:

Which party is making the certification (importer, exporter, or producer).

Certifier details: name, title, address, phone number, email.

Exporter details: name, address, email, phone number.

Producer details: name, address, email, phone number.

Importer details: name, address, email, phone number.

Description and HTSUS number to, at least, the six-digit level.

Origin criteria.

Blanket period (if applicable).

The following statement: “I certify that the goods described in this document qualify as originating, and the information contained in this document is true and accurate. I assume responsibility for proving such representations and agree to maintain and present upon request or to make available during a verification visit, documentation necessary to support this certification.”

Signature and date.

Several freight forwarders and UPS have templates for this information available on their sites.

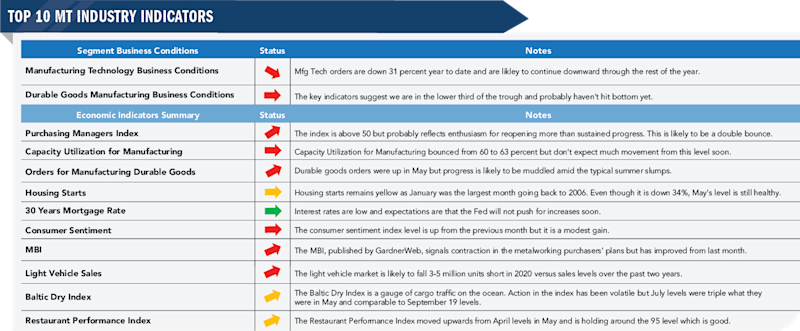

As the first half of the year came to a close, the numbers posted in USMTO were not promising, but there were promising signs. Durable goods orders were growing, though still significantly lower than the monthly levels early in 2020. The Bureau of Labor Statistics published back-to-back months where employment numbers showed hefty jumps. The Bureau also shared that the layoff rate has fallen to pre-COVID-19 levels, adding some traction to the higher employment numbers.

The market for manufacturing technology hasn’t hit bottom yet, and the recovery is going to take more time than in the past. Remember: Investments in manufacturing technology are near the end of the economic train. This market is always one of the last to recover. The train’s engine is manufacturing output and consumer spending. There are a lot of cars on this train that will have to move forward, and slack needs to be taken out of the cars between the engine and new investment in manufacturing technology. But the good signs – like the increase of 8% in durable goods orders in May, people going back to work, and consumer sentiment climbing 7% – indicate that the economic engine is building up steam – not that it has left the station yet. Our recovery is still months away.