DOWNLOAD AMT'S FULL COMMENTS ON THE EPA'S PIP (3:1) BAN HERE.

This is an update to an earlier article, which may be found here.

AMT recently filed comments on an Environmental Protection Agency (EPA) rule that bans a chemical widely used in manufacturing. Phenol, isopropylated, phosphate (3:1) (PIP (3:1)) is prevalent in most electrical parts or their manufacture and in the lubricants and cutting fluids used in operating manufacturing technology equipment. In addition, it is used as a fire retardant in constructing electrical boxes and frames. The rule is scheduled to go into effect in September 2021, and there are currently no known alternatives for PIP (3:1).

Background On January 6, 2021, the EPA issued five rules under the Toxic Substances Control Act (TCSA) banning the use of certain chemicals determined to build up in the environment over time and which therefore pose potential risks for exposed populations. Of the five chemicals, PIP (3:1) represents the most significant challenge.

On March 8, 2021, the EPA announced a 60-day public comment period to collect additional input from affected parties. At the same time, the EPA issued a temporary 180-day "No Action Assurance,” indicating the agency will exercise its enforcement discretion regarding the prohibitions on the processing and distribution of PIP (3:1) for use in articles and the articles to which PIP (3:1) has been added. After which, the ban will be effective. The public comment period ended May 17, 2021.

Comments In our comments, AMT noted the lengthy process of identifying, finding, and integrating PIP (3:1) alternatives. Although equipment already in place is exempt from the rule, replacement parts for the equipment are not exempt. From the comments:

"Once the ban becomes effective, if it takes more than 18 months to comply, more than 50 percent of U.S. capacity to manufacture could be idled due to the inability to service the equipment with replacement parts that do not include PIP. The longer it takes to develop an alternative or for the supply chain of spare parts to develop qualifying alternatives, the greater the percentage of our production capacity will be idled."

AMT urged the EPA to reconsider the ban on PIP (3:1) and instead work with industry to develop alternatives to the substance, or at a minimum, extend the compliance period from months to 5-8 years. The comments also requested that replacement parts be available for the lifetime of equipment already in place.

AMT members should take immediate action

Read and understand the published rules and restrictions, and research their applicability to any relevant processes or products.

Engage with your supply chain to help identify parts or materials that may contain listed substances. This knowledge is the first step to assessing risks, considering alternatives, and making decisions.

Document your due diligence, data-gathering, and decision-making process to demonstrate your company's commitment to compliance efforts.

Evolving the U.S. economy

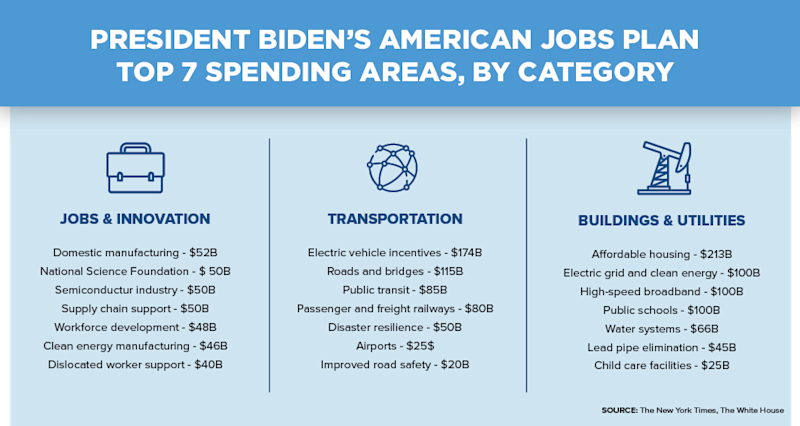

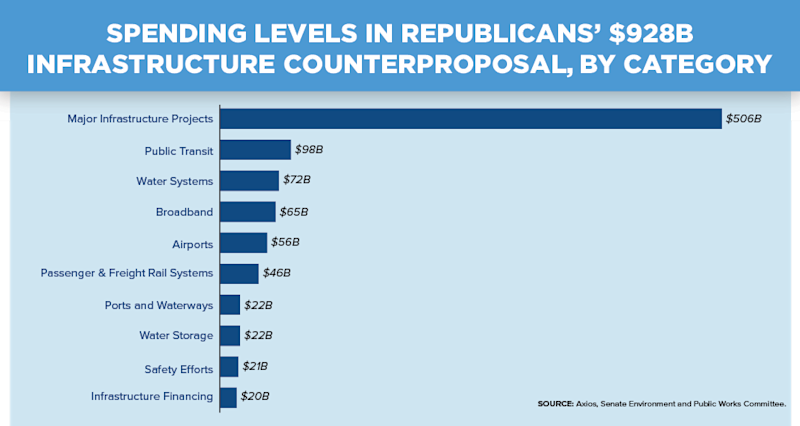

The Biden administration continues to promote the president’s $2 trillion American Jobs plan aimed at creating jobs and addressing infrastructure. Senate Republicans have countered with a proposal of less than half the size. Biden’s plan is a comprehensive overhaul, pushing domestic manufacturing, electric vehicle incentives, affordable housing, climate technology, and much more. The GOP’s plan emphasizes traditional infrastructure, including funding for improved roads, ports, airports, water infrastructure, and broadband expansion.

How will we pay for it? Breaking down the funding.

President Biden’s American Jobs Plan: $2 Trillion

Raising corporate tax rate to 28%

Raising tax on U.S. firms’ foreign income

Altering taxes on foreign corporations

Discouraging U.S. firms from claiming residence in other countries

Discouraging job offshoring

Removing deductions on foreign-derived intangible income (FDII)

Instituting minimum tax of 15% on corporate book income

Removing fossil fuel tax preferences

Increasing corporate enforcement

Senate Republican Counterproposal: $928 Billion

Maintains President Trump’s corporate tax rate of 21%

Repurposing federal funds

Instituting user fees

AMT continues to work with other trade associations and business organizations whose members are impacted by the PIP (3:1) rule and will provide updates on requirements or timelines. Please contact me at athomas@AMTonline.org for additional information.