Tariffs remain a top concern across the manufacturing technology sector. In the second quarter of 2025, the research team at AMT – The Association For Manufacturing Technology surveyed 59 member company executives to assess the ongoing impact. The “Tariff Impacts on Manufacturing Technology: 2025 Q2 Spot Survey” data revealed more than just price increases. Executives shared additional concerns, including operational stress, strategic uncertainty, and a need for sustained advocacy. Here are five key takeaways shaping how we respond as an industry.

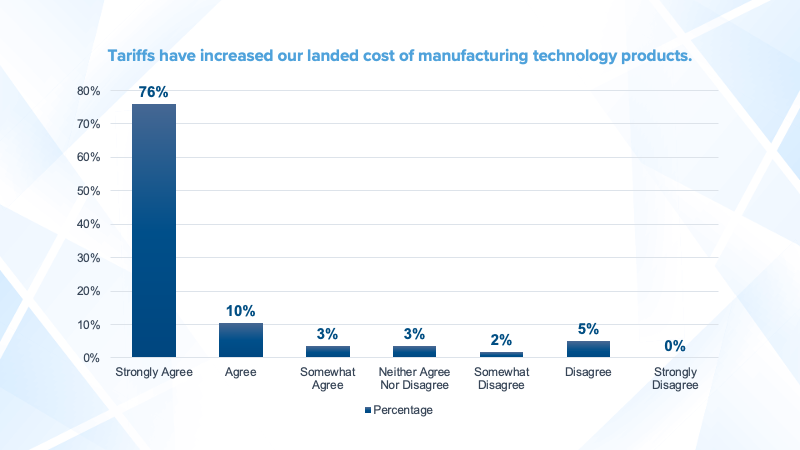

1. Costs Are Up; Margins Are Down

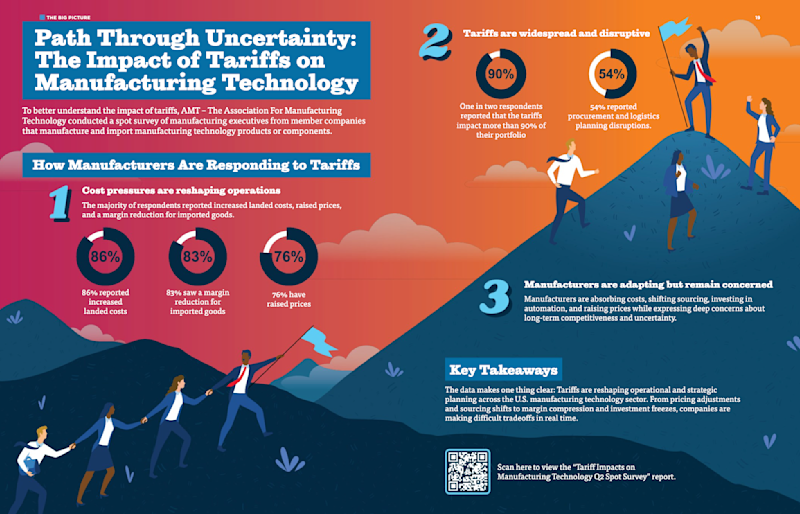

A commanding majority of respondents, 86%, report increased landed costs tied to tariffs, and 83% say their margins on imported goods have taken a hit. Most firms are passing costs on to customers: 76% say they’ve raised prices. Others are absorbing the increases internally, putting added pressure on profitability.

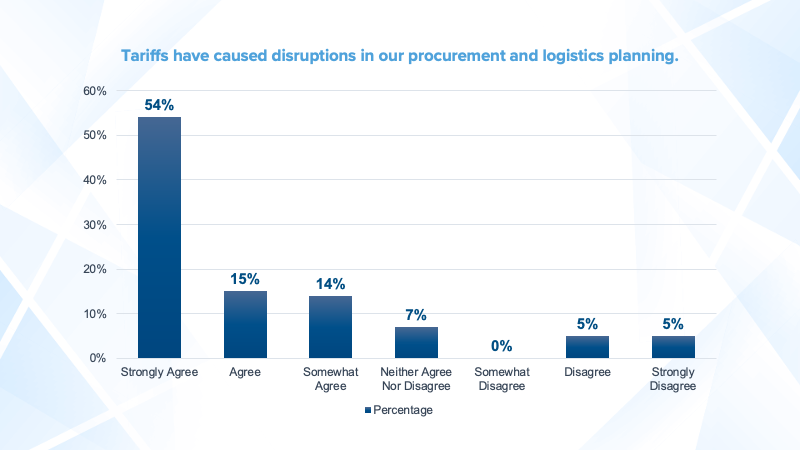

2. Tariffs Touch Nearly Everything

Half (49%) of member companies say 90% or more of their portfolio is impacted. Over half (54%) report disruptions in procurement and logistics planning. Tariffs are not targeting niche categories – they’re hitting nearly every corner of the manufacturing technology supply chain.

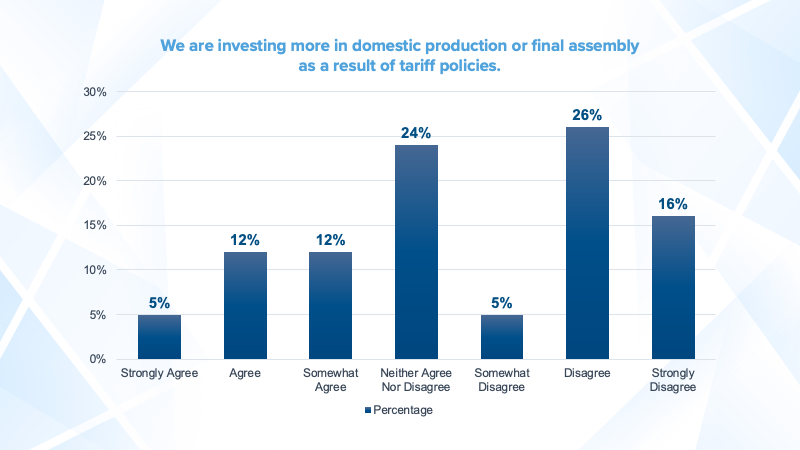

3. Companies Are Adapting — but Cautiously

While some manufacturers are shifting sourcing and exploring domestic final assembly, others are waiting for policy clarity before making major moves. Uncertainty around enforcement timelines and tariff scope makes long-term planning difficult.

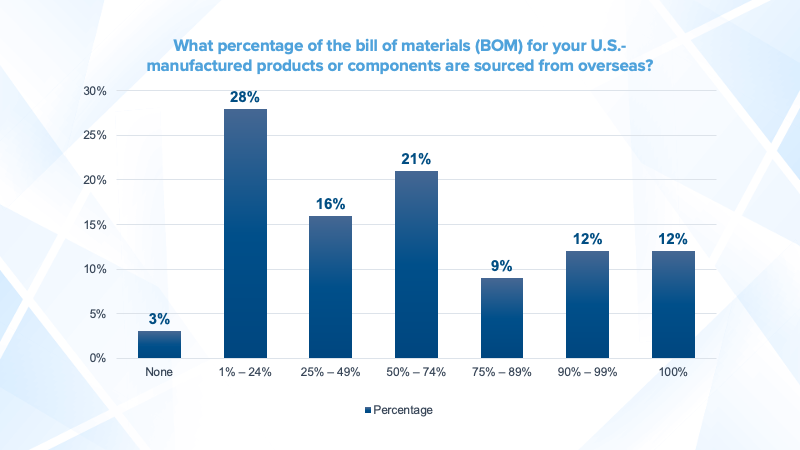

4. Global Supply Chains Remain Critical

At 54%, more than half of the respondents’ materials are sourced internationally. This deep integration with international supply chains limits the short-term flexibility of reshoring strategies and underscores the need for stable trade relations.

5. Uncertainty Is the Biggest Barrier

Policy volatility, not just the tariffs themselves, is the top concern. Executives repeatedly emphasized that constant shifts in policy, lack of transparency, and unpredictable enforcement undermine investment and confidence. As one respondent put it: “The uncertainty is as painful as the tariffs.”

What’s Next?

AMT supports President Donald Trump’s administration’s goal of creating a level playing field and strengthening U.S. manufacturing. However, the uncertainty surrounding tariffs – their broad scope and inconsistent implementation – continues to challenge our industry. As the backbone of national defense and economic growth, manufacturing depends on a stable and predictable policy environment. Many members have emphasized the importance of sharing their stories with local representatives. You are encouraged to leverage the data – this is your story, and it’s a powerful one: Find my representative.

Negotiations between individual countries and the Trump administration are ongoing. Deals were recently struck with China and the U.K.

To find the most up-to-date information on tariffs, refer to these sites:

U.S. Trade Representative – Presidential Tariff Actions

U.S. Customs and Border Protection - Trade Remedies

To learn more, download the full “AMT Tariff Impacts on Manufacturing Technology Survey Report.”

We are stronger together, especially during times of change. If you have questions about this or any other research need, please feel free to reach out or submit a research request.