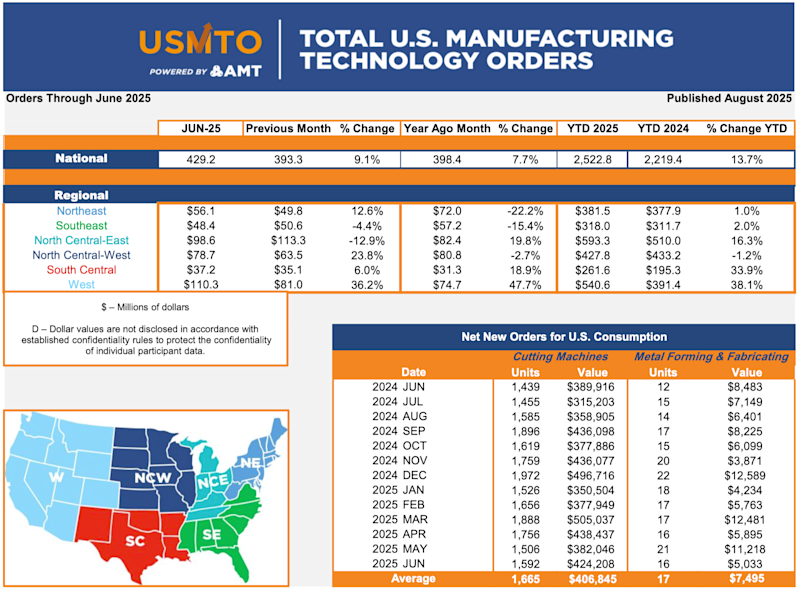

McLean, Va. (August 11, 2025) — New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $429.2 million in June 2025. This was a 9.1% increase from May 2025 and a 7.7% increase from June 2024. Machinery orders placed through June 2025 totaled $2.52 billion, a 13.7% increase over the first half of 2024.

The value of orders in the first half of 2025 is 21.2% higher than for the average year, whereas units ordered in the first half of 2025 are 17.2% lower. This trend underscores the increasing importance that automated machinery has played in the market for manufacturing technology in recent months, with added options and features increasing order values. Such automated solutions allow companies to gain additional productivity at current workforce levels, bridging the gap caused by the shallow, upward trend of industrial output and the continued decline in employment.

Contract machine shops, the largest consumer of manufacturing technology, have shown signs of recovery after lagging behind the overall market for much of 2024. Both the value and unit count in new orders are up 12% compared to the first half of 2025. Looking forward, this customer segment could weaken in the remainder of the year, as a higher percentage of shops report an unwillingness to invest in additional machinery over the next 12 months.

After surpassing $300 million in total investment in the second half of 2024, the aerospace sector continues to invest at a rapid clip, increasing the value of orders by 6% in the first half of 2025 to the highest level recorded. Although news of a strike among some of Boeing’s defense workers could be interpreted as a negative sign, the last strikes at the end of 2024 propelled substantial investment in manufacturing technology.

Increased demands for electricity and the equipment needed for its generation and distribution have been dominant trends for several months. Demand for machinery from electrical equipment manufacturers has fallen by 19% compared to the first half of 2024, but the value of orders is still 24% above average. By contrast, manufacturers of engines, turbines, and other power transmission equipment increased orders by 19% compared to the first half of 2024, as many data centers supplement what is provided by municipal power grids with on-site generators.

Primary metal manufacturers have increased orders of manufacturing technology by nearly 50% from the first half of 2024 to the highest level since the second half of 2022. This increased investment comes as North America increases crude steel production, one of the few regions to do so, and executives report higher quotation activity and growing backlogs.

Uncertainty has been the primary economic driver through the first half of 2025, and the first few weeks of the second half show few signs of that instability abating. In AMT’s Summer Economic Update Webinar on Aug. 7, Oxford Economics revised its forecast upward to show modest single-digit growth in machinery orders in 2025. While this is an improvement over their previous estimates, it implies a significant decline in order activity to erode the 13.7% growth gained through the first half of 2025. At the same time, ITR Economics forecasts a strong second half of 2025 for cutting tool consumption, lifting orders for the year. While these forecasts seem at odds at first glance, cutting tool consumption tends to peak about two quarters after a peak in machinery orders. As the rest of 2025 unfolds, the health and trends of U.S. consumers and businesses will reveal if the momentum thus far will continue – or if cyclical peaks are on the horizon.

The United States Manufacturing Technology Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing Technology, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity. USMTO.com.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, AMT acts as the industry’s voice to accelerate the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and market intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. Learn more at AMTonline.org.

IMTS – The International Manufacturing Technology Show is where the creators, builders, sellers, and drivers of manufacturing technology come to connect and be inspired. Attendees discover advanced manufacturing solutions that include innovations in CNC machining, automation, robotics, additive, software, inspection, and transformative digital technologies that drive our future forward. Powered by AMT – The Association For Manufacturing Technology, IMTS is the largest manufacturing technology show and marketplace in the Western Hemisphere. With more than 1.2 million square feet of exhibit space, the show attracts visitors from more than 110 countries. IMTS 2024 had 89,020 registrants, featured 1,737 exhibiting companies, and included a Student Summit that attracted 14,713 visitors. Be the change at IMTS 2026, Sept. 14-20, 2026. Inspiring the Extraordinary. IMTS.com.