It was a busy September in Washington. Self-imposed deadlines on the infrastructure and budget reconciliation bills ran up against predetermined deadlines to fund the government beyond Sept. 30 and raise the debt ceiling before it crashes sometime in the coming weeks.

Although the infrastructure bill received bipartisan support in the Senate, it began to dwindle as House Democrats focused on passing the $3.5 trillion reconciliation measure alongside it. And Republicans were not the only ones to object to the hefty price tag. Other Democrats don’t think the bill goes far enough. West Virginia Senator Joe Manchin, a Democrat, declined to support the bill even after a personal appeal from President Joe Biden. Democrats can’t afford to lose any votes in the Senate and only hold a razor-thin majority in the House.

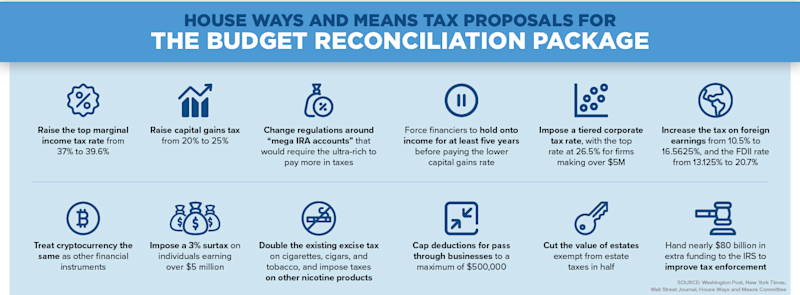

Also, troublesome for opponents beyond the size of the package is how to pay for it. The tax increases include raising the top individual and corporate rates, accelerating the reduction in the estate tax exemption scheduled to take effect in 2025, raising the capital gains rate, and a slew of international tax provisions.

A provision in the package that positively impacts the industry is the four-year extension of expensing R&D costs in the year incurred. The Tax Cut and Jobs Act required R&D costs to be amortized over five years, beginning in 2022. Now, there are new deadlines for work unfinished from last month. For infrastructure, it’s Oct. 31, a date tied to the end of the highway fund extension. Congress will also have to fund the government beyond the Dec. 3 extension. A reduced reconciliation package is also in the works.

EPA proposes new rule-making on PIP (3:1) ban

As first reported on AMT Online, the U.S. Environmental Protection Agency (EPA) announced it would initiate new rule-making to reduce exposure to the five PBT chemicals it banned in January, including one widely used in manufacturing, PIP (3:1). The same announcement extended the date to comply with the PIP (3:1) ban to March 8, 2022, from Sept. 4, 2021.

The EPA will soon issue a notice of proposed rule-making, seeking comment on another compliance extension for PIP (3:1) articles beyond March. The agency wants more details on specific uses of PIP (3:1) throughout the supply chain, the steps taken to identify substitute chemicals for those uses, and an estimate of any additional time required to gather such information. Public comments will be accepted in docket EPA-HQ-OPPT-2021-0598 on www.regulations.gov for 60 days from publication of that proposed rule.

China figures prominently in Biden’s Global Trade Strategy

The Biden administration continued efforts to strengthen trade relations in Southeast Asia and around the world to counterbalance China’s growing global influence. Read my colleague Ed Christopher’s recent article on AMT Online pointing out the relevance to AMT’s Global Services Strategy of Vice President Kamala Harris’ recent trip to Singapore and Vietnam. The president also announced the formation of AUKUS, a new partnership between Australia, the United Kingdom, and the United States to share defense technology.

China’s recent application to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (formerly called the Trans-Pacific Partnership) illustrates a similar coalition-building strategy. Although the Obama administration supported the agreement, Biden pledged not to sign it because of concerns from labor and environmental groups. Current participants are Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam.