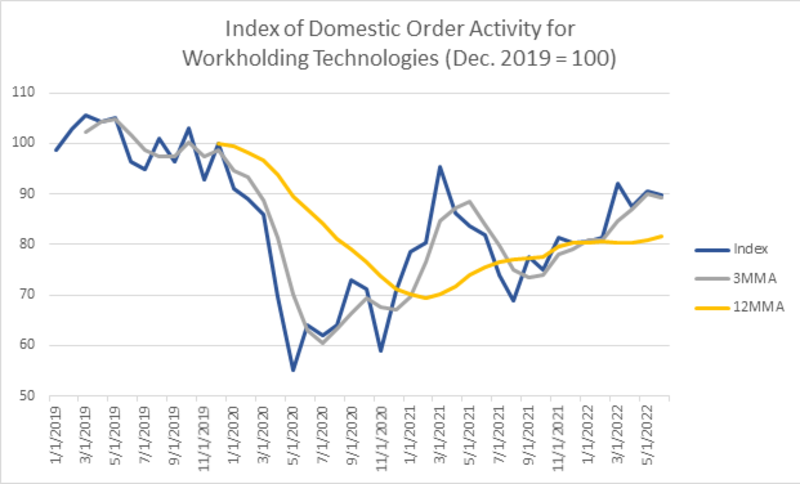

Orders of workholding technologies totaled $162.7 million in the first half of 2022, of which $21 million was for export, according to the Advanced Workholding Technology report, published by AMT – The Association For Manufacturing Technology. Orders in 2022H1 were 13.1 percent above orders in 2021H2 and 3.3 percent above the first half of 2021.

“The workholding segment of the machine tool industry has been strong in 2022,” said Jamie Schwarz, president of BISON USA Corp. and chair of AMT’s Advanced Workholding Technology Committee. “Domestic business has increased significantly over the past two years and business in export markets is trending upward. Backlogs are trending down which I believe to be related to the easing of supply chain constraints. I anticipate the workholding market to be strong through the end of the year especially with the increase in business typically associated with an IMTS year.”

Both domestic orders and exports were at the highest level since the second half of 2019. In addition to taking on new orders, manufacturers of workholding technologies reported declining backlogs in every month of 2022 after hitting a peak of just above $60 million in January 2022. Average monthly employment among workholding manufacturers is at the highest level since the first half of 2019.

“Over the last two years, we have seen several industries bring production back to the United States to shorten and secure supply chains,” said Douglas K. Woods, president of AMT. “This has created a need for additional capacity, which we have been seeing in the data on machinery orders. In addition to the workholding needed for the new machinery, the growing mix of parts now produced domestically are fueling an uptick in overall demand for workholding technologies.”