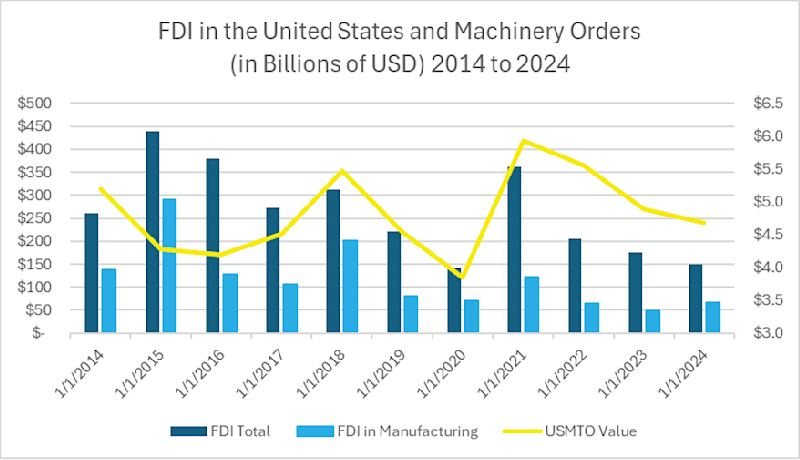

According to the Bureau of Economic Analysis, which compiles data on foreign direct investment (FDI), the amount spent by foreign investors to acquire, establish, or expand businesses in the United States in 2024 totaled $151 billion. The majority of this investment, $67.7 billion, or nearly 45%, went into the manufacturing sector, driven primarily by $23.7 billion in chemical manufacturing.

Except for a large spike in 2021, total FDI in the United States has declined steadily since reaching a record level in 2015. Of the three categories of FDI, the largest – by far – is the amount foreign investors spend to acquire U.S.-based businesses. The far smaller portion, greenfield investments, represents foreign investors establishing new businesses in the United States or expanding operations to include a new facility. In 2024, greenfield investments reached just over $8 billion, with $1.57 billion in the manufacturing sector.

This article will examine the links between FDI and manufacturing technology demand, exploring the nuances and reasons for the data’s trends.

Plot Twist

Using data from the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, we can plot FDI data alongside new machinery orders. This reveals that, except for two years since 2015, manufacturing technology orders generally increase in years that FDI increases, and decline when FDI declines. Quantifying this pattern, a moderately positive correlation appears between the percent change in FDI in a year and the percent change in the value of USMTO orders. The percent change in the number of units ordered has a nearly equal but slightly weaker correlation.

Additionally, an interesting pattern emerges from the data: The total amount of FDI going into the United States had a stronger correlation with new manufacturing technology orders than FDI in just the manufacturing sector. What’s more, greenfield investments in manufacturing – the types most likely to require additional machinery – has a weaker correlation with manufacturing technology orders than with total FDI. This analysis, while terse, could indicate that while FDI and machinery orders tend to be correlated, no causal link has been established between increased investments from foreign nationals and machine tool purchases. In generally good economic situations, expanding U.S.-based businesses and purchasing machinery to meet growing demand for discrete parts are both attractive investments.

A Vital Investment for Your Business

Despite continued economic uncertainty, recently extended and expanded tax provisions for manufacturers could induce additional machinery purchases. Expert guidance can help manufacturing technology providers plot their course through these competing winds. Get those insights, updated market forecasts, sector outlooks, trend breakdowns, and exclusive networking opportunities to create better business plans and strategies at AMT’s 2025 MTForecast conference on Oct. 15-17 in Schaumburg, Illinois. Visit AMT Online to learn more and register.

To read the rest of the International Issue of MT Magazine, click here.