TECHNOLOGY

Opportunity Lives Between the Sectors

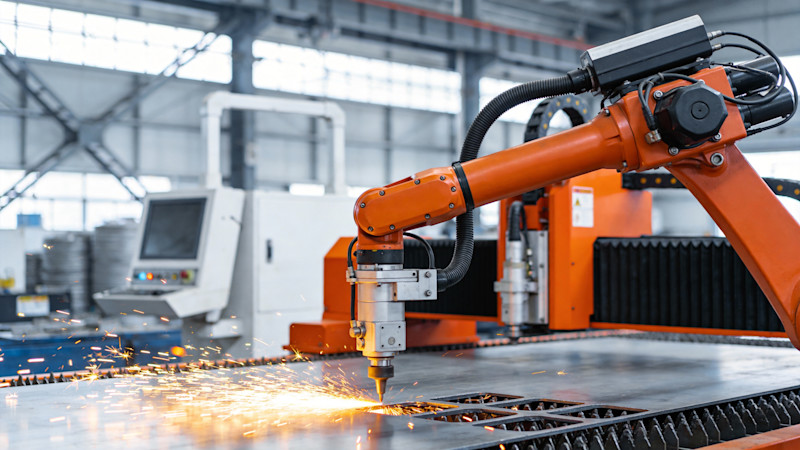

Sometimes the fastest path to growth isn’t in your market – it’s in someone else’s. For example, a decade ago, as electric vehicles gained popularity, some oil and gas suppliers with idle capacity pivoted to machining parts for electric vehicles. Today, that same principle holds. Sector-specific slowdowns often leave high-value capabilities sitting unused, while emerging markets – like clean energy, aerospace, or defense – face capacity shortfalls. The key is visibility and flexibility. Manufacturers who understand their strengths and stay open to cross-sector work can thrive where others stall. In an unpredictable economy, diversification isn’t a hedge – it’s a strategy.

INTERNATIONAL

Strategies for Shifting Opportunities in Global Market Sectors

Opportunities in the global industrial sector for manufacturers are never constant. Tracking and capitalizing on them is an ever-changing game of chess. In volatile times, prioritize sectors that maintain or increase investment, such as pharmaceuticals, defense, energy, and utilities, where demand and regulatory pressures create steady equipment needs. There are also nice opportunities in semiconductors, logistics automation, and renewable energy. Target emerging markets – India, Vietnam, Indonesia, and Mexico – where industrial growth and government incentives drive automation spending. When mainstay sectors like automotive and aerospace slow down, shift emphasis to retrofits, productivity upgrades, and service contracts rather than new machine sales. Develop sector-specific ROI tools and application engineering to differentiate yourself from your competitors. Build partnerships with local integrators and distributors who specialize in your target industries.

Monitoring global trends and opportunities can be daunting. For some help, turn to AMT’s weekly International News From the Field column on AMT Online, which can help guide you in allocating your global resources.

SMARTFORCE

Running Out of Candidates? The Student Summit Has Thousands

The Smartforce Career Pathways program at IMTS 2026 connects you directly with the next generation of manufacturing talent. More than 15,000 students will attend the Smartforce Student Summit, including over 5,000 college and university students actively exploring their career options. It is a powerful way to put your entry-level openings in front of a motivated, future-focused audience.

Participating IMTS exhibitors receive prominent placements on two large-format digital job boards inside the Student Summit, located in Hall C of the North Building at McCormick Place, as well as extended visibility in the Smartforce section of IMTS.com through the end of 2026. Each listing includes your logo, booth number, up to three open entry-level roles, and a QR code linking directly to your IMTS digital showroom.

Whether you are hiring interns, apprentices, or new graduates, Smartforce Career Pathways helps you build brand recognition, connect with emerging talent, and show your commitment to workforce development. Contact summit lead Catherine “Cat” Ross at cross@AMTonline.org to secure your spot.

ADVOCACY

2025 Wrap-Up and 2026 Outlook: Manufacturing Policy

2025 marked a significant year for U.S. manufacturing policy, with Congress enacting several long-standing industry tax priorities. Permanent bonus depreciation, restored R&D expensing, continuation of the passthrough deduction, and increased Section 179 thresholds collectively provide greater certainty for capital investment, innovation, and small-business planning across the manufacturing technology sector.

Looking ahead to 2026, trade policy will continue to be a central focus. The Trump administration continues to advance a layered tariff strategy, maintaining Section 301 duties on Chinese imports, pursuing reciprocal tariff frameworks, and progressing with Section 232 investigations involving industrial machinery and robotics. These developments are expected to impact pricing, sourcing decisions, and supply chain planning for manufacturers and technology providers.

In parallel, Congress may revisit competitiveness, workforce, and supply chain legislation, while federal agencies, including those at the departments of Commerce and Defense, continue industrial base assessments and reshoring initiatives. Taken together, 2025 delivered tax stability, and 2026 is poised for sustained activity in trade and industrial policy.

INTELLIGENCE

Lower Bank Rates To Start 2026

The Federal Reserve controls the money supply to maximize employment and the dual mandate is to acheive maximum employment and maintain price stability. Because monetary policy shapes borrowing costs and business expectations, it can strongly influence investment in new manufacturing technology. Interestingly, orders for manufacturing technology, according to AMT’s USMTO survey program, have remained fairly robust throughout 2025 despite the elevated interest-rate environment.

Against that backdrop, the Fed’s latest move – a third consecutive quarter-point cut to a 3.5%-3.75% target range – helps set the tone for 2026. Updated projections point to stronger expected GDP growth, a gradual easing in unemployment, and inflation holding slightly above target. Machinery orders were already firming in late 2025, and improved financial conditions could support continued capital investment. Still, growing dissent within the Federal Open Market Committee reflects lingering uncertainty. As the Fed navigates the competing pressures of its dual mandate, manufacturers will be watching closely for signals that shape technology spending in the year ahead.

To read the rest of the Industry Updates Issue of MT Magazine, click here.