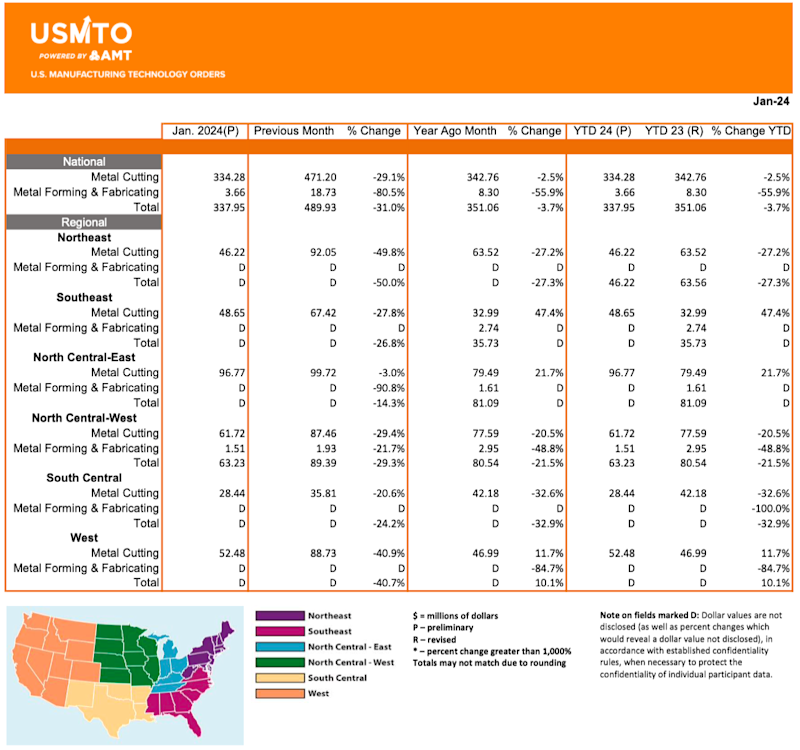

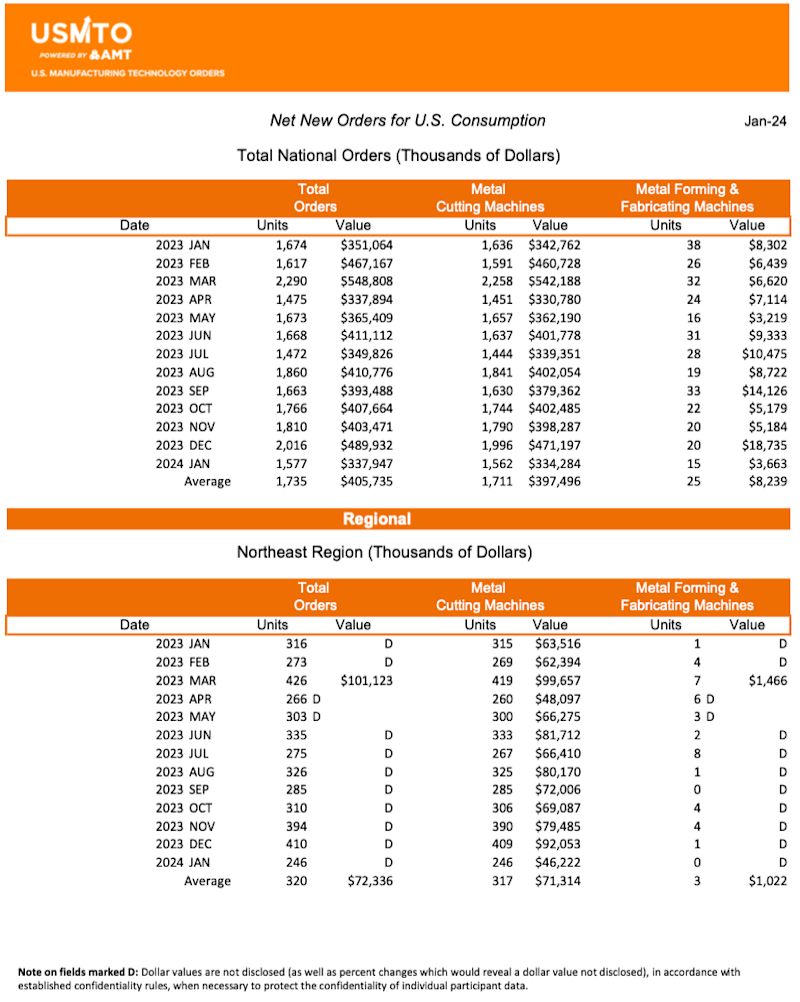

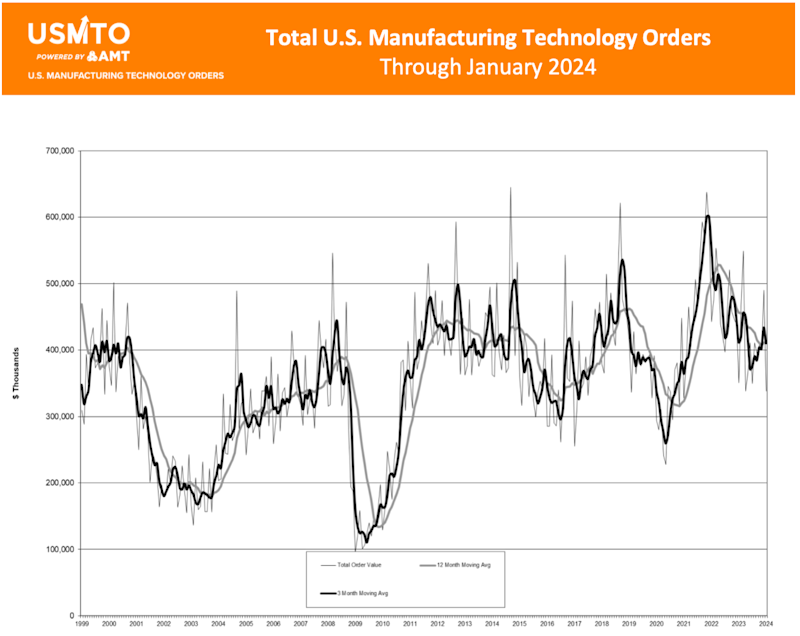

McLean, Va. (March 12, 2024) — Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $338 million in January 2024, a 31% decline from December and a 3.7% decline from January 2023. The value of orders in January 2024 were at the lowest level for a January since 2021, yet the unit count was the lowest since 2016. This indicates the demand for manufacturing technology is still being driven by orders of highly specialized, automated machinery.

Contract machine shops, the largest customer of manufacturing technology, decreased orders in January 2024 to the lowest level since July 2023, a 27.1% decline from December 2023. These shops have been ordering below their typical share for some time now. Should business conditions improve for these manufacturers, there is a large upside potential for future orders of manufacturing technology.

Contract machine shops are expected to continue experiencing subdued order activity in the near future. Despite a minor improvement in February 2024, the Gardner Metalworking Index – compiled by Gardner Business Media and predominantly based on responses from contract machine shops – indicates that the downturn in business activity is likely to persist for at least another month.

Outside of the aerospace and automotive sectors, OEMs in many other industries are generally small consumers of manufacturing technology in any given month relative to the size of orders from contract machine shops. However, for some time now, this has inverted, as OEMs across several industries have increased orders at a pace that has nearly offset the decline in orders from contract machine shops.

Manufacturers of oil and gas field machinery were among the OEMs increasing orders in January 2024. According to data published by the Texas Oil and Gas Association, 2023 set records in both the extraction and refining of oil and natural gas in the state. In recent years, elevated orders for manufacturing technology from this sector have typically been placed in the fourth quarter of the year. The early uptick in 2024 could indicate an appetite to expand capacity and modernize equipment to compete with recent regulatory hurdles.

January is typically the slowest month for manufacturing technology orders in any given year, and 2024 may prove to be no different. Forecasters at Oxford Economics have predicted that global industrial production will increase 2.7% in 2024. This bodes well for manufacturing technology, as even non-durable goods producers require machinery that is built using the metalworking equipment tracked by USMTO. Indeed, Oxford Economics also presented a forecast at AMT’s Winter Economic Forum, predicting that manufacturing technology orders in the United States would increase nearly 8% in 2024.

# # #

The United States Manufacturing Technology Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing Technology, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity. USMTO.com.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, Virginia, near the nation’s capital, AMT acts as the industry’s voice to speed the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. AMTonline.org.

IMTS – The International Manufacturing Technology Show is where the creators, builders, sellers, and drivers of manufacturing technology come to connect and be inspired. Attendees discover advanced manufacturing solutions that include innovations in CNC machining, automation, robotics, additive, software, inspection, and transformative digital technologies that drive our future forward. Powered by AMT – The Association For Manufacturing Technology, IMTS is the largest manufacturing technology show and marketplace in the Western Hemisphere. With more than 1.2 million square feet of exhibit space, the show attracts visitors from more than 110 countries. IMTS 2022 had 86,307 registrants, featured 1,816 exhibiting companies, saw over 7,600 people attend educational events, and included a Student Summit that introduced the next generation to manufacturing. Be the change at IMTS 2024, Sept. 9-14, 2024. Inspiring the Extraordinary. IMTS.com.