A key factor in becoming customer-centric and ensuring that you stay ahead of the competition is defining your value proposition. Because the perception of value is subjective – relying on the eye of the beholder – it is necessary to establish what constitutes value to your customers. Doing that in international markets may be even trickier than in our domestic market. Nevertheless, it may also be more rewarding.

Finding out what my customers valued most about their suppliers and how to differentiate my products and services was both revealing and exciting. Throughout the years, through trials and errors, I concluded that to assess my customers’ perception of value, I needed to understand three things:

Their business culture and decision-making processes.

Their wants, needs, concerns, and what the customer would do if they do not buy from me.

How my solutions, products, and services will impact their business, their competitiveness, and, ultimately, their success.

Because making the effort to understand these points was unexpected, customers showed great appreciation and a willingness to do business with my company rather than with our competitors. It became a considerable differentiating factor.

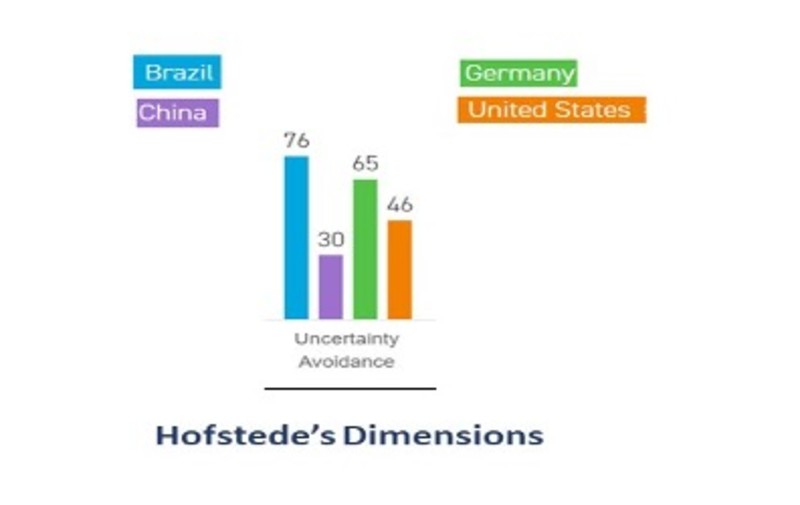

When dealing with international markets, one must stay alert and sensitive to the differences in perceptions and priorities when determining what constitutes value. Because different cultures present different behaviors, it is always a good idea to understand the variations of subjective decisions. One helpful tool that I use frequently is Hofstede’s cultural dimensions theory. One of its dimensions in particular helps you understand your customer’s behavior: the “uncertainty avoidance index.” If you look at the graph below, it is easy to understand the relative level of acceptance of uncertainty when negotiating in Brazil, China, Germany, or the United States.

Understanding what constitutes value to our customers provides a much smoother sales process, allowing fewer errors and creating a feeling of collaboration that enhances personal relationships.

I also learned that what I thought was valuable to our customers when dealing with my company was not always what customers perceived as valuable to them. A classic example is when a salesperson enhances the technical features of a product but does not highlight its benefits in addressing the customer’s value perception – how it solves their specific problem or need.

There are several models out there to help you build a value proposition for your marketing efforts. There are various mapping methods I used and liked throughout the years that allowed me to visualize and prioritize the perception of value of my customers and clients. More recently, I came across a company called Strategyzer that created a Value Proposition Canvas that I find to be a helpful tool.

Once we understand what represents value to our customers, it becomes much easier to find out how our products address each element of their perception of value.

To better understand the local business culture at your international target markets, take advantage of the expertise available to you at two important resources:

Commercial Service Officers at the U.S. embassy in your target market deal with exporters like you on a daily basis and can provide expert advice on a range of issues.

AMT’s Global Service staff, both in McLean and at the international technology centers, provide comprehensive marketing and sales support on generic or manufacturing technology-specific issues.

This is the third in a series of articles dedicated to sharing strategies for entering and conducting manufacturing technology business in international markets.

Read the first in this series, “How To Determine If There’s an International Market for Your Product.”

Read the second in this series, "Branding in International Markets."

Mario C. Winterstein, CEO at International Business Development Group Inc., writes Mario’s Global Beat for AMT. Fluent in six languages, Winterstein is a business and international trade strategist in marketing, sales, and service support management for the metal working industry. His career spans 34 years planning, implementing, and managing international marketing, sales, service organizations, and starting “green-field” manufacturing plants. Mario spent 17 years as a director at AMT supporting members with their global growth. During his tenure, he served as staff liaison for several AMT committees, conducted foreign trade missions, and stood up and presided over the AMT Tech Centers in Mexico and Brazil. He is a member of the D.C.-Virginia District Export Council (DEC), duly appointed by the U.S. secretary of commerce. He lives and works in Herndon, Virginia.

If you have any comments, concerns, or questions, please contact Mario Winterstein at mwinterstein@ibdgi.com.