In the first part of this article, published in the previous issue of AMT News on August 16, we introduced you to the market opportunity of Mexico’s mold and die manufacturing industry. In this second part, we review the state of the mold and die industry by geographic locations.

The Mexican Association of Mold and Die conducted a survey to assess the technical capabilities of a sample of 215 companies. Below I present its findings as well as the expected capabilities needed to strengthen and grow Mexico’s mold and dies sector.

Retrofit capabilities for plastic injection molds

Micro welding for cavities repair

Mold holder and die holder fabrication

Flexibility to incorporate engineering changes

Software for simulation and analysis

Develop infrastructure to manufacture dies weighing 40 or more tons

Develop infrastructure to manufacture plastic injection molds weighing six or more tons

Develop infrastructure to manufacture stamping dies weighing more than 70 tons

The current manufacturing technology deployed in Mexico allows the manufacturing of dies up to 20 tons and stamping up to 30 tons, which is a small sample of the demand as the bulk ranges in larger systems and products.

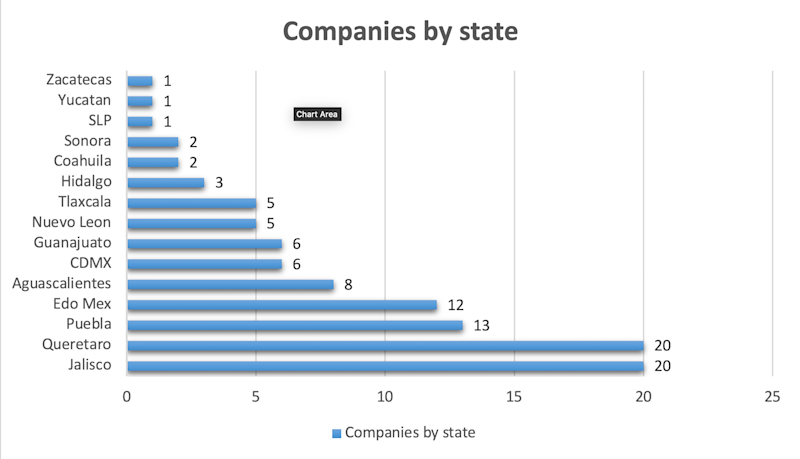

To date, there are 15 states with the largest concentration of mold and die shops.

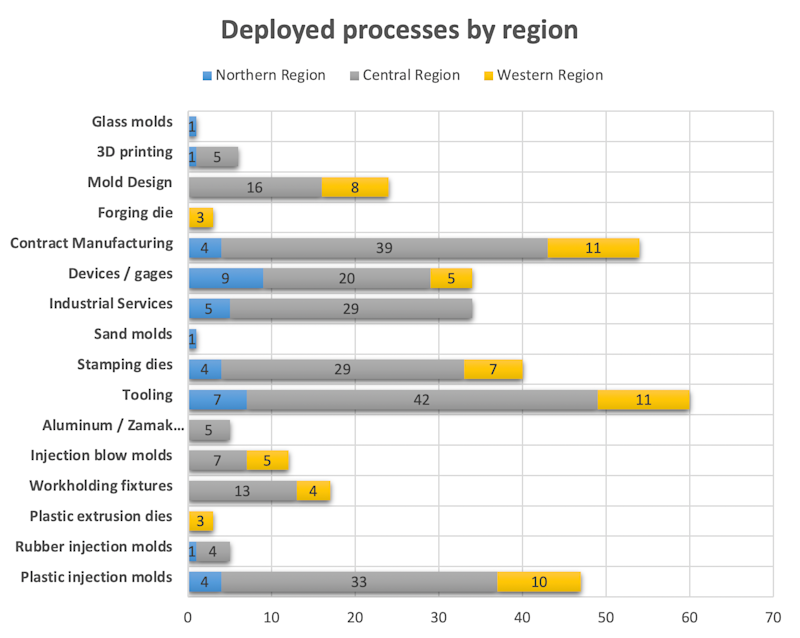

Now lets take a deep dive into the processes currently installed in Mexico.

There is a strong effort to upgrade the industry’s capabilities by engaging the many players and stakeholders that can have a direct impact on the output. From suppliers of metals and alloys to capital goods manufacturers, the involvement of AMT with this initiative is oriented to grow the consumption of Mexican made molds and thus the demand of capital goods for its manufacturing.

According to the study, the current and most used materials in Mexico are:

Ferrous

Steel

Stainless steel

Special steels

Tool-grade steel

PTR

C3

D2

D15

4140

K 340

Iron

Nodular Iron

P20

Plastic materials

Engineering plastics

Resins and additives

PVC

Teflon

Acetal

Nonferrous

Copper

Bronze

Graphite

Tungsten carbide

Wood

Aluminum

Another key process, discussed in every hall and meeting of AMMMT, that will impact Mexico’s mold and die production as well as the industrial ecosystem, is 3D printing machines or additive manufacturing. Automation and artificial intelligence (AI) are two other transformative technologies that will impact mold and die manufacturing, as forecasted by ISTMA and embraced by AMMMT.

AMT will continue participating in the regular meetings held by AMMMT and is involved as a “strategic member” of ISTMA Americas as a result of the professional relationship capital built by AMT in both Mexico with AMMMT and with Brazilian Association of Mold and Die Manufacturers (ABINFER).

To date we are expeditiously strengthening the available market intelligence regarding who is who in Mexico’s budding mold and die industry. We are excited about the “dawn of a new industry,” which is bound to favorably impact the rest of the consumer industries due to its ubiquitous influence.