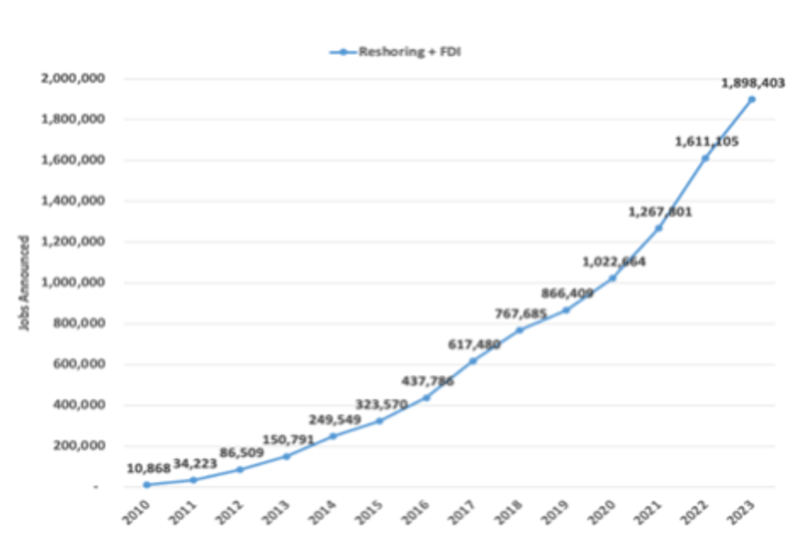

The Reshoring Initiative’s recently released annual report depicts trends in reshoring and foreign direct investment (FDI) which indicate a robust movement towards strengthening U.S. manufacturing amid global uncertainties. Reshoring plus FDI job announcements in 2023 reached 287,000 jobs, the second-highest year on record. Figure 1.

Essential goods supported by U.S. industrial policies account for 39% of the job announcements with electrical vehicle (EV) battery and semiconductor investments accounting for the lion’s share. Let’s dive in.

Strategic policies and global events Collective global events of the past several years, including the pandemic, geopolitical risk, and new industrial policies, have triggered a sea change in globalization. Strategic U.S. policies and world events will continue to shape the landscape, driving investments that shorten supply chains, enhance domestic supply chain resilience, and bolster economic security. Recent trends in reshoring and FDI are demonstrating significant strength and longevity. Geopolitical risk and climate change have aligned corporate strategy and U.S. industrial policy, leading to a notable increase in U.S. manufacturing investments.

Figure 1: Reshoring Initiative Library: Reshoring + FDI annual job announcements in 2023 added 287,000 jobs, the second-highest year on record.

Figure 2: Reshoring Initiative Library: The cumulative number of jobs brought back since 2010 is nearing two million (Figure 2) - about 40% of what we lost to offshoring.

— Key takeaways —

Growth in essential industries Substantial growth has been observed in “essential” industries, particularly those supported by the Inflation Reduction Act (IRA), CHIPS and Science Act, and other government funding. Top products include electric vehicle (EV) batteries, semiconductor chips, and solar energy.

Future of subsidies and policies With government funding beginning to wane, new reshoring and FDI announcements are showing signs of slowing. Future progress will have to depend heavily on policies that enhance long-term U.S. manufacturing cost-competitiveness, such as tax, trade, and regulatory policy; rather than relying solely on subsidies.

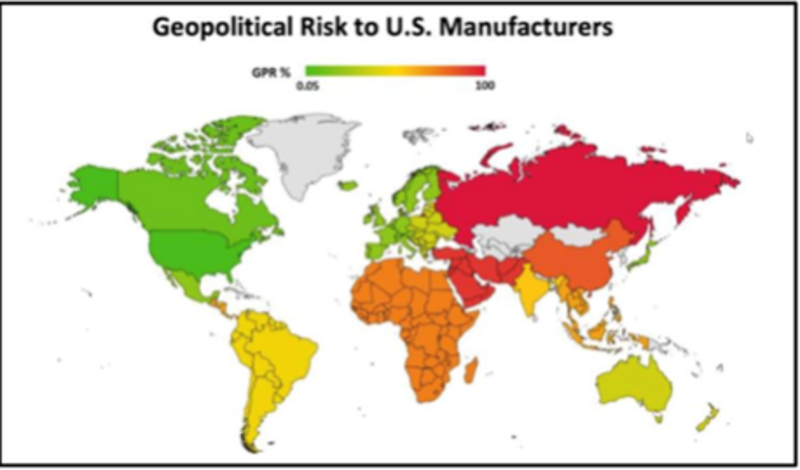

Geopolitical risks: the #1 driving force in reshoring and FDI trends Most of the top factors for reshoring relate directly to supply chain optimization, which is focused on reducing costly risks from geopolitical and climate change events. Incidents such as COVID-19 shutdowns, the war in Ukraine, the Israeli/Hamas conflict, increasing tension over Taiwan, and the possibility of decoupling with China, highlight the urgent need for companies to consider reshoring and nearshoring as safeguards against catastrophic disruptions. Figure 3 shows the level of risk, the annual probability of decoupling by country or region. A table includes for each country numerical values of geopolitical risk and detailed analysis.

Figure 3: Geopolitical Risk measure

Europe: The ongoing conflict in Ukraine is expected to continue directing FDI from Europe to the U.S., primarily due to concerns over natural gas and electricity availability and pricing.

Israel: The Hamas attack on October 7, 2023, is anticipated to influence FDI trends moving forward, although it was too late to impact 2023 data. Nearly all cases from Israel are FDI — its companies have long understood the value of having assets in the U.S. FDI was steady from 2013 to 2021 and then dropped to close to zero in 2022 and 2023.

Taiwan: Rising tension between the U.S. and China over Taiwan is a key factor in industrial policy, leading corporate strategists to increasingly consider how to assure component availability as a critical part of their long-term planning. FDI was by far the stronger trend, peaking in 2022 with several massive Taiwan Semiconductor Manufacturing Co (TSMC) facilities.

China: China has the highest combination of huge trade dependency, single sourcing and geopolitical risk. Reshoring and FDI from China are near historical highs, with reshoring alone at an all-time high of 87%.

Calculating Risk with TCO Companies can utilize the Reshoring Initiative’s free TCO Estimator and Geopolitical Risk measure to compare alternative and local sourcing options. Geopolitical risk (GPR) is defined as the likelihood that, within one year, a significant disruption in trade will occur, causing the U.S. to stop importing goods from a particular country due to a negative geopolitical event.

Skilled workforce The success or failure of recruiting and training millions of workers will determine the outcome of the current reindustrialization momentum, in either direction. Trends are moderately positive, e.g. manufacturing apprenticeships up 83% in the last 10 years. About 49% of our 2023 cases mentioned skilled workforce availability as a reason they reshored, essentially tied for #2 with Proximity to Customers.

Are you thinking about reshoring? Presently, shifting forces are creating more incentives and opportunities for companies to produce at home. The Reshoring Initiative advocates to make even more work reshorable by policies like massive increases in skilled workforce recruitment and training and a lower USD. Are you thinking about reshoring? For help, contact me at 847-867-1144 or email me at harry.moser@reshorenow.org.

Read the full report: Reshoring Initiative 2023 Annual Report: Reshoring and FDI Job Announcements Reach 287K - Second Highest Year on Record