OEMs Shifting to Total Cost of Ownership Would Reshore Billions More

A core goal of U.S. trade policy over the last decade has been reshoring manufacturing back to the United States and strengthening the domestic industry for economic and national security. The 2025 USA Reshoring Survey, a collaboration between the Reshoring Initiative and Regions Recruiting, attracted over 500 respondents and offers insight into original equipment manufacturers’ (OEMs) and contract manufacturers’ (CMs) perceptions of and barriers to manufacturing reshoring.

The Reshoring Survey expands the scope of reindustrialization research by shifting focus to three important dimensions of reshoring.

Understand the decision-making process or the “why” companies reshored.

Understand the perspective of the CMs in the supply chain.

Explore actions needed to accelerate the trend.

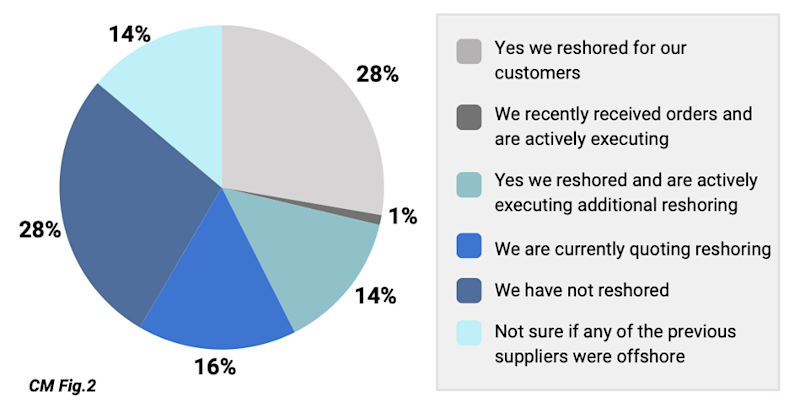

The survey determined that 59% of CMs have either already reshored for their customers, are actively reshoring, or are currently quoting reshoring. This article will focus on the CM responses.

Fundamental Insights

A cohesive U.S. strategy emphasizing workforce training and recruiting, as well as supply chain innovation, will be paramount to the success of reshoring a robust U.S. manufacturing sector.

The survey reached two actionable conclusions. First, a sufficient quantity and quality of U.S. workforce would bring back more manufacturing than any of the other surveyed options – tariffs, a lower U.S. dollar, lower tax rates, or fewer regulations. If we do everything else to boost global competitiveness but don’t have anybody to work in the factory, it’s all purposeless.

Second, successful reshoring requires an established ecosystem of suppliers and intermediaries, such as the contract manufacturers surveyed, encompassing all steps from raw materials to finished product.

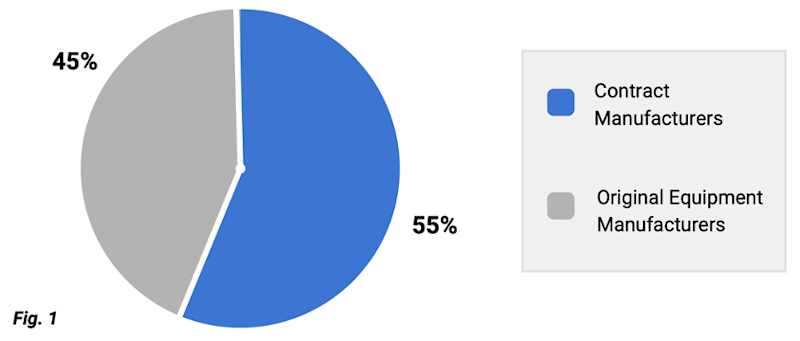

A contract manufacturer is defined as manufacturing parts, components, or tooling to be used in an OEM end product. Fifty five percent of relevant respondents were CMs, compared to 45% OEMs. (See Figure 1.)

Respondent Demographics

Why Did They Reshore?

The survey found that 43% of CMs have reshored for customers or are actively executing orders to reshore, while 16% are currently quoting on reshoring. (See Figure 2.)

Have You Reshored Any Manufacturing to the United States for Your Customers, or Are You Expecting To?

Competing Against Imports

When the CMs were asked about quoting against imports, the survey found that CMs competed with imports on about 31% of quotes, with only 7% facing no offshore competition and 3% competing with imports on every quote.

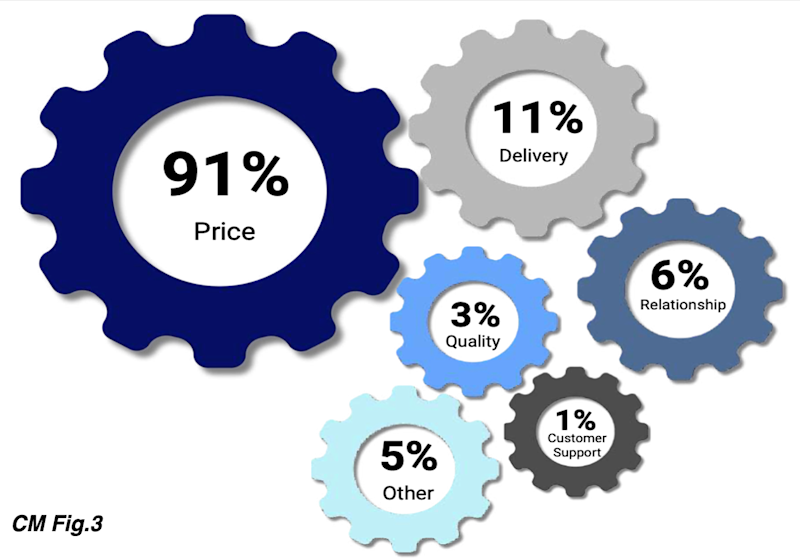

Ninety-one percent of respondents indicated that a primary reason they lost orders to imports was price. This aligns with the findings from OEMs, where 69% cited cost as their main factor for offshoring. (See Figure 3.)

Sixty-eight percent of contract manufacturers responded that for orders they lost to imports, the import FOB price was 20% to more than 50% lower than their own. As a weighted average, prices of winning imports were about 24% lower than CM prices.

Principal Reasons You Lost Orders to Imports

But most manufacturers aren't doing the math correctly when comparing offshore versus domestic sourcing.

The survey revealed the priorities for America’s reindustrialization:

Level the cost playing field.

Grow the skilled workforce.

Use total cost of ownership (TCO).

Prepare for geopolitical risk.

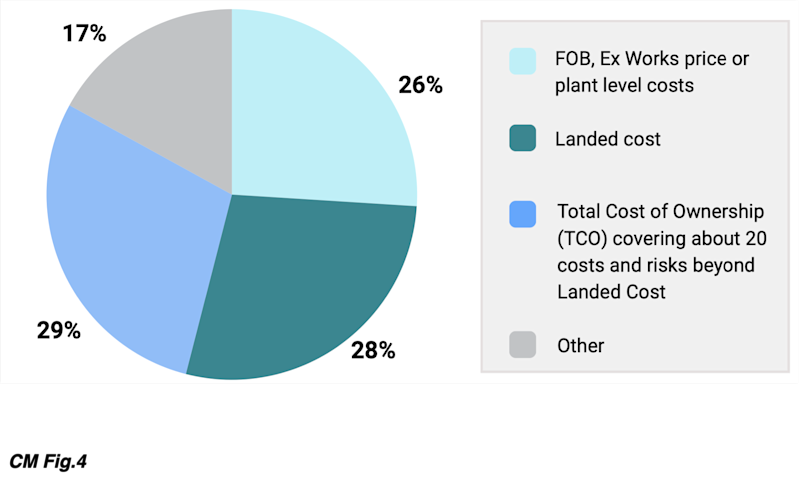

CMs said that the bases most of their customers are using to compare offshore versus domestic options are nearly evenly split between FOB/Ex Works/Plant Level Manufacturing Cost at 26%, Landed Cost at 28%, and Total Cost of Ownership at 29%. (See Figure 4.)

Oftentimes, these methods result in a 20%-30% miscalculation of actual offshoring costs. The Reshoring Initiative’s Total Cost of Ownership (TCO) Estimator is a free online tool that helps companies account for all relevant factors – overhead, balance sheet, risks, corporate strategy, and other external and internal business considerations – to determine the true total cost of ownership.

On What Basis Are Most of Your Customers Comparing Offshore vs. Domestic Options?

Adopting TCO Would Reshore Billions

CMs believe the OEMs are using simplistic cost comparisons. Shifting to TCO would reshore $200 billion of manufacturing with no government subsidies, no supply chain shock, no retaliation, and no impact on inflation after companies factored in all global risks and costs.

Contract manufacturers should use TCO to make a case with customers when competing with offshore competitors. For example, Morey Corp., an Illinois-based electronics CM, reported that TCO was the key to winning a $60 million order when competing against a lower-cost Chinese competitor.

A weighted average shows that CMs estimate that if they could recover all the work they’ve lost to imports since 2000, their sales would be 26% higher today.

CMs Reshoring: A Typical Scenario

CMs believe their customers onshored mainly for: Quality/Rework/Warranty (61%), Delivery Time (54%), and (less risk of) Supply Chain Disruptions (50%). Other significant reasons were having Manufacturing Near Engineering (22%), Brand/Image Made in USA (22%), and Freight and Duty (22%).

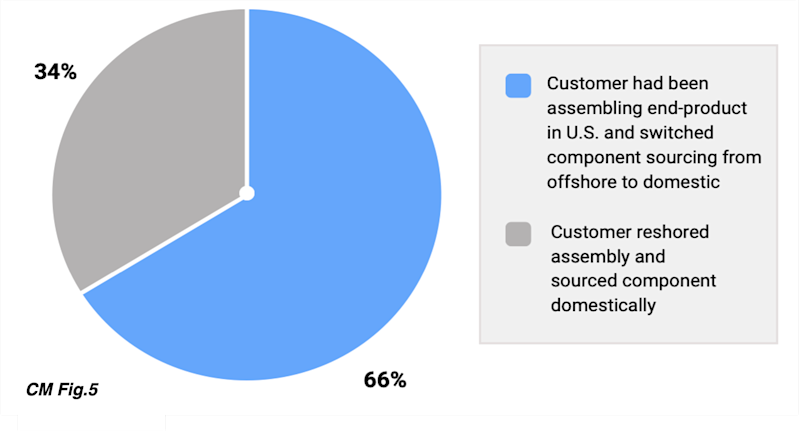

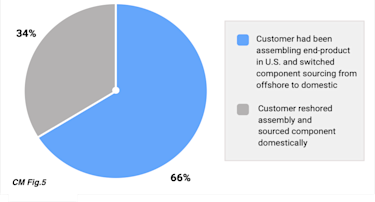

The typical scenario for CMs reshoring is an OEM customer with U.S. assembly operations shifting sourcing of components, parts, or tooling from offshore to a domestic supplier. This is reflected in Figure 5, showing that 66% of respondents’ reshoring was from customers assembling the end product in the United States and were moving component sourcing onshore. Thirty-four percent said their OEM customers reshored both assembly and sourcing.

The survey results reveal that many manufacturers are considering the collaborative benefits of locating manufacturing near engineering, and they are placing a high value on the quick delivery achieved by localization strategies. As more assembly comes back, there will be another surge of work for CMs.

Which of the Following Scenarios Best Fits Your Cases of Reshoring?

Competitiveness: One-Week Delivery vs. Six Weeks

Forty percent of OEMs were willing to pay 10%-20% more to shorten delivery times by five weeks. This premium for shorter lead times points to a great opportunity for CMs. Typical delivery time by surface freight from inland China/Asia to the Midwest is about six weeks.

Insights From the IMTS/AMT Reshoring Survey Subset of CMs

We compared the survey responses from IMTS exhibitors and AMT members to the full set of national survey responses. The IMTS/AMT CM subgroup said their customers used TCO 50% of the time to compare offshore to domestic options. Thirty-three percent of the CM subgroup always used TCO as a sales tool when competing with imports, but 50% never used TCO to make a case with customers when competing with offshore competitors, and 17% said they rarely used it. The CM subgroup that never or rarely uses TCO as a sales tool will win more business by adopting TCO.

When the CM subgroup was asked why they weren’t succeeding more at reshoring, 100% indicated workforce (75% cost and 25% availability). Overall, the subgroup findings were consistent with national findings. A sufficient quantity and quality of the U.S. workforce would bring back more manufacturing, and adopting TCO would drastically increase reshoring.

The bottom line: There's a simple tool that can flip sourcing decisions – but many companies aren't using it.

Are You Thinking About Reshoring?

We encourage companies to implement the top priorities for reindustrialization revealed by the survey – build a strong talent pipeline, use total cost of ownership, and prepare for geopolitical risk.

For help, contact me at 847-867-1144 or email me at harry.moser@reshorenow.org. As part of our effort to recognize manufacturers leading the reshoring movement, the Reshoring Initiative will present the National Metalworking Reshoring Award at FABTECH 2025 and IMTS 2026.

Read the full 2025 Reshoring Survey Report.

This article was written with Kathy Nunnally, President of Regions Recruiting.

The Reshoring Survey findings underscore that addressing the skilled labor shortage is the top priority for successful reindustrialization and reshoring in the United States. Without a robust, well-trained workforce, ambitious reshoring goals will face significant delays. The proactive measures by certain states and companies offer a blueprint, emphasizing the need for a more cohesive, national commitment to shifting mindsets and investing in comprehensive workforce development programs.

Click here to access the full article, “Priority #1: Manufacturing Workforce Development,” authored by Kathy Nunnally.

For expert guidance and support with talent strategies to advance your business, contact Kathy Nunnally, President of Regions Recruiting, at knunnally@regionsrecruiting.com, or call the office at 404-636-2161.