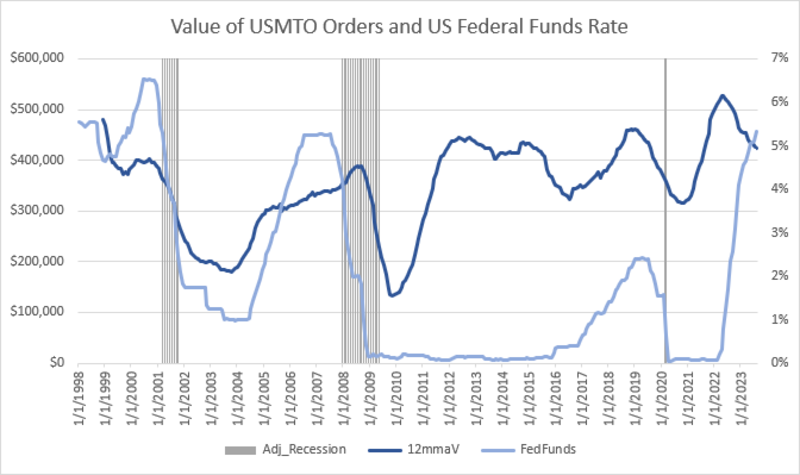

When the Federal Reserve began their interest-rate-hiking campaign to combat inflation in March 2022, many questioned how quickly the effects would be felt broadly in the economy. In response, Fed officials often evoked the phrase coined by economist Milton Friedman on monetary policy, that such actions changed economic conditions after “long and variable lags.” Notably, at a June 14, 2023, press conference, Fed Chair Jerome Powell deviated from the famously ambiguous guidance, saying, “It’s still the case that what you see is interest-sensitive spending is affected very, very quickly – so housing, and durable goods, and things like that. But broader demand, and spending, and, and asset values, and things like that – they just take longer.”

Source: AMT - USMTO Survey, Federal Reserve Board of Governors

Recent trends captured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology indicate that orders for manufacturing technology indeed responded “very, very quickly” to the rate-hiking cycle. Since March 2022, a near-perfect negative correlation has appeared between the federal funds rate and the 12-month moving average of the value of manufacturing technology (MT) orders as well as the number of units ordered. However, this pattern in the data disappears over a longer time span. Further, when looking solely at the rate-hiking cycles over the past two decades, the response of MT orders seems to vary significantly. This article will compare the trends in the 12-month moving average of MT orders over the three previous interest-hiking cycles to the present one.

Rate-Hiking Cycles Since 1999

The first cycle we will examine began in June 1999 and ended in May 2000 after a cumulative 1.75 percentage point increase. Over this period, the value of MT orders trended upward, while the number of units decreased. One explanation for this is the steady decline in unemployment over the previous several years as the manufacturing workforce grew. Unemployment fell from a peak of 7.8% in June 1992 to a low of 3.8% in April 2000 as industrial production increased by over 47% in the same period.

Between June 2004 and June 2006, the Fed raised interest rates 4.25 percentage points to cool the economy after the rapid recovery following the 2001 recession. Unemployment only started to tick up in the six months prior to the official start of the Great Recession in December 2007, but industrial production continued to grow until the first few months of the official recession. MT orders increased in value over this period; the number of units ordered increased slightly, but not at the same pace.

Between December 2015 and December 2018, the Fed attempted to raise rates away from the extremely accommodative 0% that had been in place since the end of the Great Recession in 2009. The period before these hikes saw inflation struggling to reach the 2% target and a surprisingly lengthy return to the pre-financial crisis trends. Both the number of units ordered and the value of orders increased nearly in tandem with the interest rate increases. This hiking cycle coincided with the end of the 2016 manufacturing recession, where orders declined, as well as the remarkable rebound that took place in 2018, which could account for the positive correlation with interest rates.

Not Interested

While the current interest-hiking cycle that started in March 2022 appears to suggest that MT orders react rapidly to changes in rates, history paints a less clear picture. Demand for MT may be less sensitive to interest rates than other products in the durable goods sector; the decline in orders relative to the current interest rate hikes may have more to do with the level of capacity reaching equilibrium with the demand for manufactured products, easing price pressures. More broadly, all cycles of rising interest rates coincide with periods of falling unemployment, increased consumption, and rising industrial production. Orders for manufacturing technology would naturally be supported during this period; as long as parts are needed to make the goods consumers and businesses need, additional machinery will be purchased to meet those demands – even in the face of rising interest rates.

To read the rest of the Economics Issue of MT Magazine, click here.