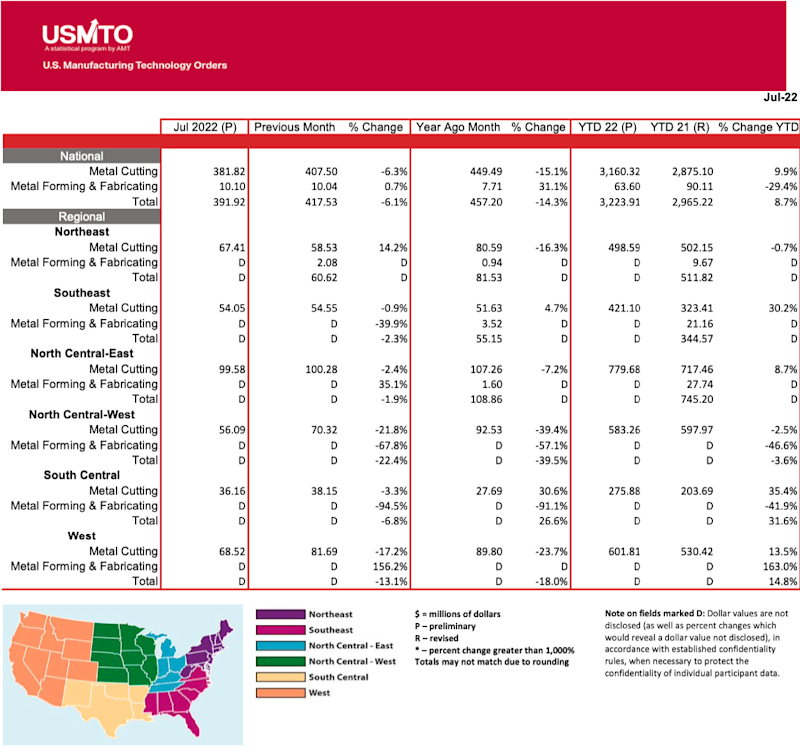

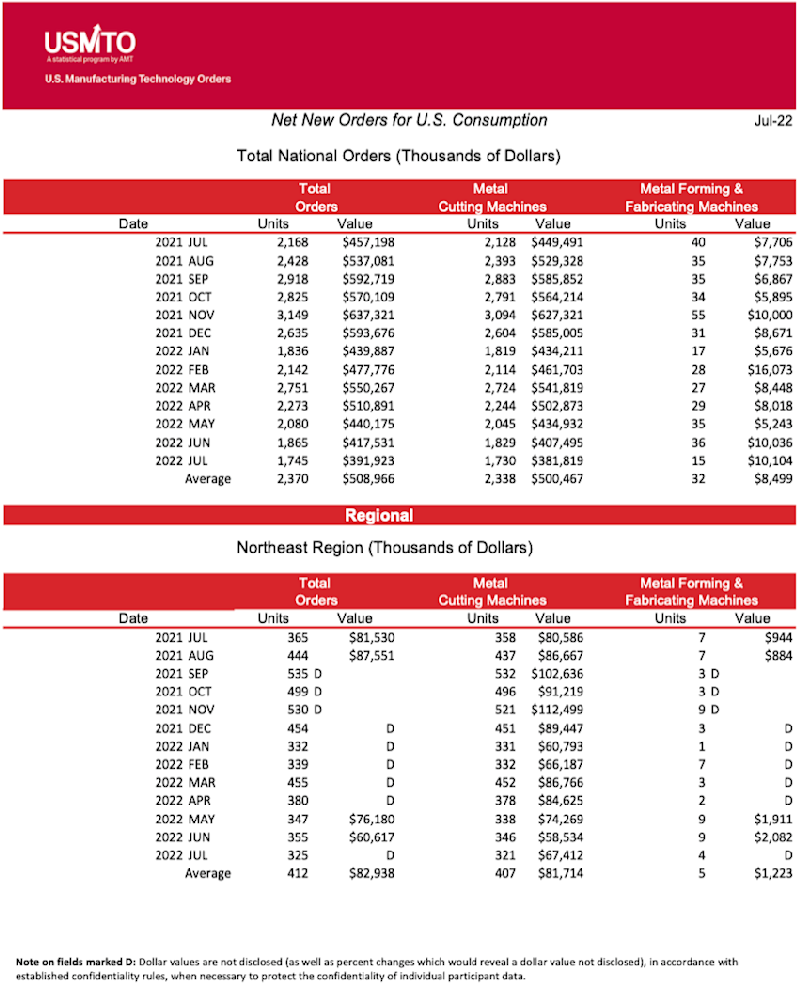

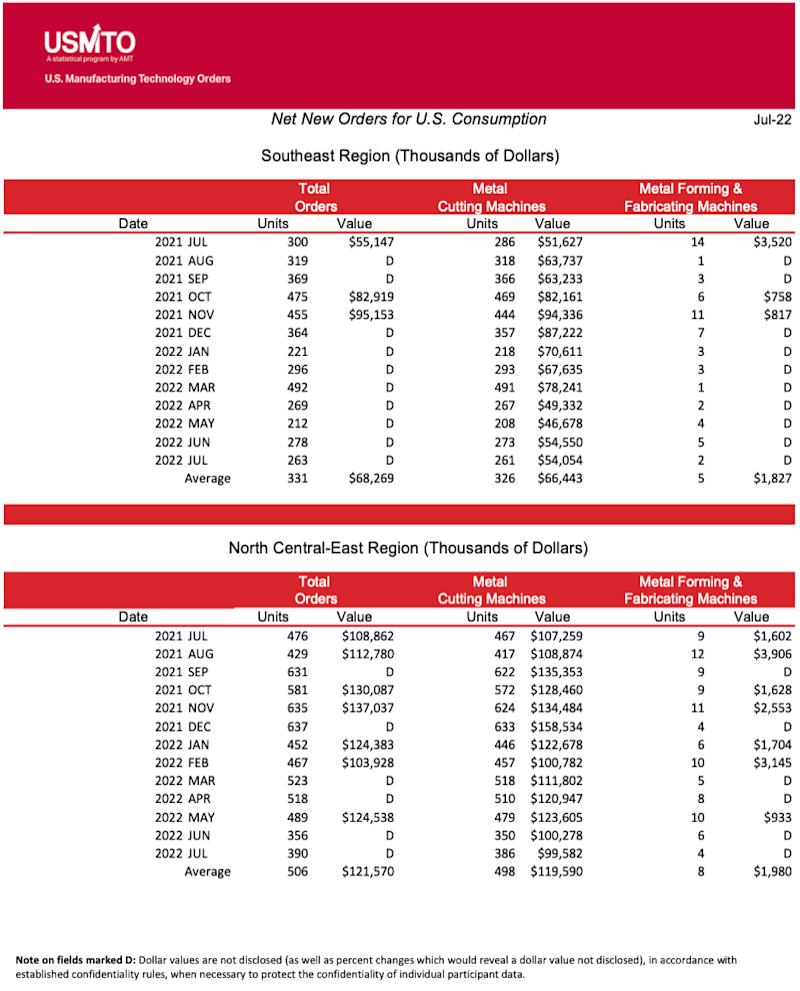

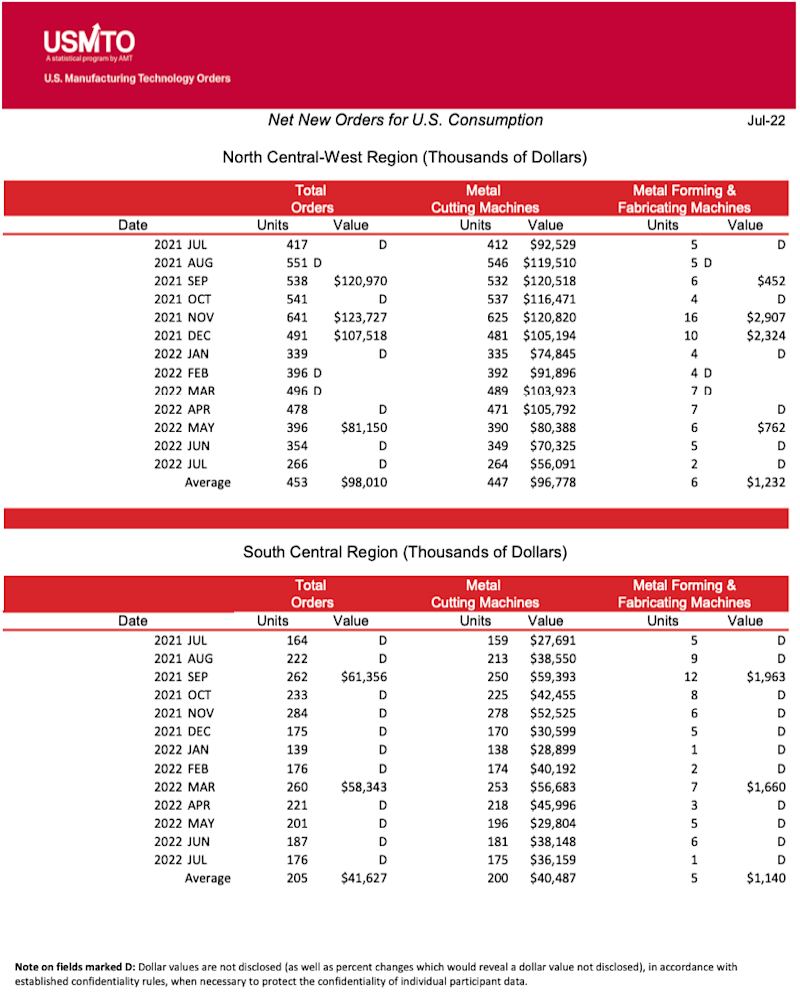

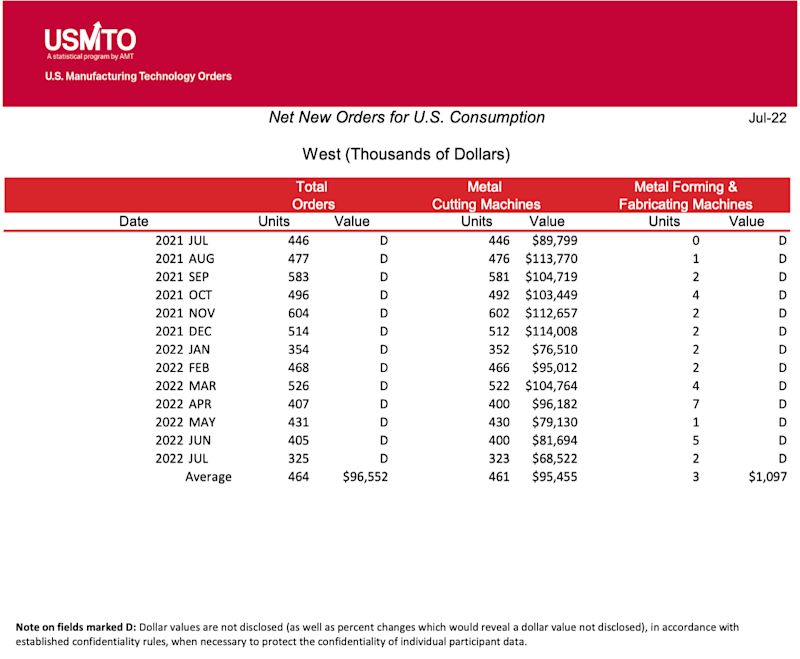

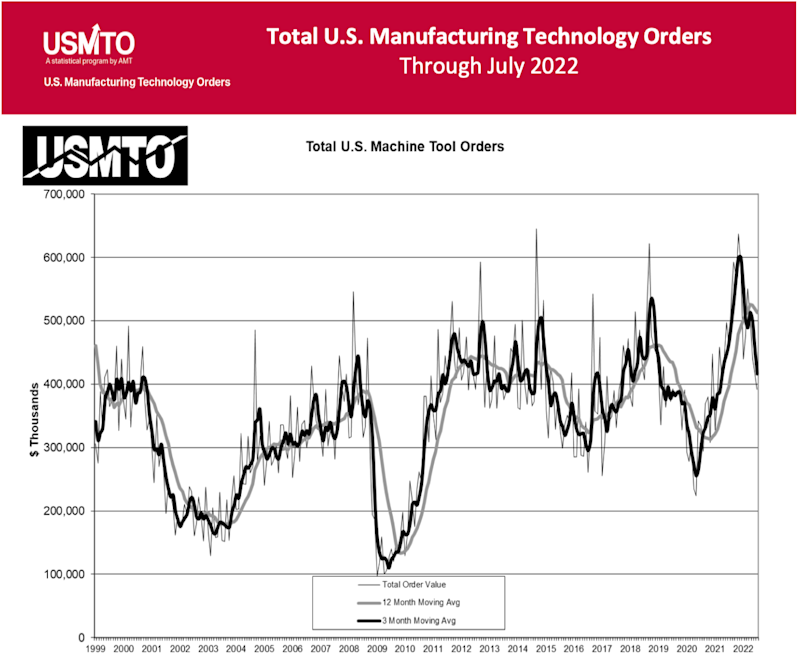

McLean, Va. (September 12, 2022) – New orders of manufacturing technology totaled $291.9 million in July 2022, according to the latest U.S. Manufacturing Technology Orders report published by AMT – The Association For Manufacturing Technology. July orders decreased 6.1% from June 2022 and were off 14.3% from July 2021. Manufacturing technology orders in 2022 have reached a total of $3.22 billion, an 8.7% increase over the first seven months of 2021.

“While July 2022 is down compared to July 2021, orders in both years were quite above what would be seen in a typical year,” said Douglas K. Woods, president of AMT. “Last year was the best on record and was particularly fueled by strong orders in the last third of the year, so it will be hard to match. However, given that orders are already nearly 9% over 2021, and with the typical boost to orders from IMTS, it appears possible to come close.”

The transportation sector, typically a driver of manufacturing technology orders, led the retreat into July. Orders placed by most motor vehicle manufacturing industries pulled back significantly in July after an outsized June order. Machine orders for railroad, ship, and other transportation manufacturing also decreased. The one bright spot in transportation was in aerospace, led by space and defense sectors, where orders nearly doubled from June to July 2021.

Manufacturing technology orders have benefited greatly from recent foreign direct investment, particularly in the manufacture of chips and batteries. “Not only has foreign direct investment in the United States benefited manufacturing in recent months, but the trend of reshoring has also greatly increased the need for additional capacity,” said Woods. “Metal valve manufacturers, whom we have highlighted in previous months, continue to place orders for machinery at levels that would be unheard of just a few years ago.

“The ongoing desire to create more resilient supply chains will continue to require more parts to be made domestically,” said Woods. “That demand has pushed manufacturing capacity utilization to an over two-decade high. If these trends continue, it could create a sustained need for additional manufacturing technologies – and particularly automation, should manufacturers continue to grapple with a shortage of labor.”

# # #

The United States Manufacturing Technology Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing Technology, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity.

AMT – The Association For Manufacturing Technology represents U.S.-based providers of manufacturing technology – the advanced machinery, devices, and digital equipment that U.S. manufacturing relies on to be productive, innovative, and competitive. Located in McLean, VA, near the nation’s capital, AMT acts as the industry’s voice to speed the pace of innovation, increase global competitiveness, and develop manufacturing’s advanced workforce of tomorrow. With extensive expertise in industry data and intelligence, as well as a full complement of international business operations, AMT offers its members an unparalleled level of support. AMT also produces IMTS – The International Manufacturing Technology Show, the premier manufacturing technology event in North America. www.amtonline.org

IMTS – International Manufacturing Technology Show - The largest and longest-running manufacturing technology trade show in the United States is held every other year at McCormick Place in Chicago, Ill. IMTS 2022 will run Sept. 12-17. IMTS is ranked among the largest trade shows in the world. Recognized as one of the world’s preeminent stages for introducing and selling manufacturing equipment and technology as well as connecting the industry’s supply chain. IMTS attracts visitors from every level of industry and more than 117 countries. IMTS 2018 was the largest in number of registrations (129,415), net square feet of exhibit space (1,424,232 sq. ft.), booths (2,123) and exhibiting companies (2,563). IMTS is owned and managed by AMT – The Association For Manufacturing Technology. www.IMTS.com