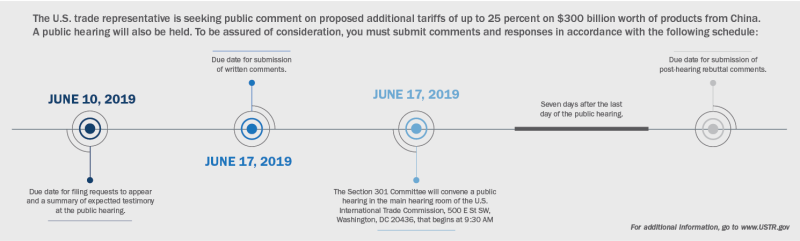

Since my last report, the U.S.-China trade negotiations that were widely expected to move forward suffered a serious setback. President Trump, unhappy with the progress, directed the United States Trade Representative (USTR) to increase tariffs from 10 percent to 25 percent on products covered by the September 2018 action resulting from current 301 investigations into China’s unfair trade practices. He also proposed a new round of tariffs if China refuses to honor commitments made over the course of the negotiations.

Here’s a timeline describing what happened in May from Markets Insider:

May 5: After apparent progress in talks, the United States accuses China of reneging on past trade commitments. The president threatens to raise tariff rates and to place duties on another $300 billion worth of Chinese goods.

May 10: President Trump follows through with those threats, increasing import taxes to 25 percent from 10 percent on about $200 billion worth of products from China. Negotiations stall, and the United States reportedly gives China a three- to four-week deadline for a deal.

May 13: China retaliates against the U.S. by announcing it will raise tariff rates on $60 billion worth of American products on June 1.

May 15: The president signs an executive order barring American companies from using telecommunications gear from foreign adversaries that officials declared a threat to national security. He also adds Huawei and dozens of other Chinese companies to the U.S. “Entity List.”

May 21: President Xi Jinping of China calls on China to begin a new “long march,” a potential signal that the country is gearing up for a prolonged fight with the United States.

May 22: President Xi visits one of the largest suppliers of rare-earth elements in the world, located in Ganzhou, China. The move was widely seen as a reminder of the leverage China holds when it comes to minerals the United States relies on for a variety of goods, from jet fuel to wind turbines.

May 23: Trump rolls out a $16 billion bailout program for farmers who have been hurt by China’s retaliatory tariffs on agricultural products.