The U.S. Supreme Court has rejected the Trump administration’s argument for reciprocal tariffs. The decision doesn't address refund procedures, and whether the tariffs have been halted immediately is unclear, creating new uncertainty around implementation.

Steel tariffs spark debate: protecting the U.S. steel industry while raising costs for manufacturers and consumers. This article explores impacts, trade-offs, and policy options.

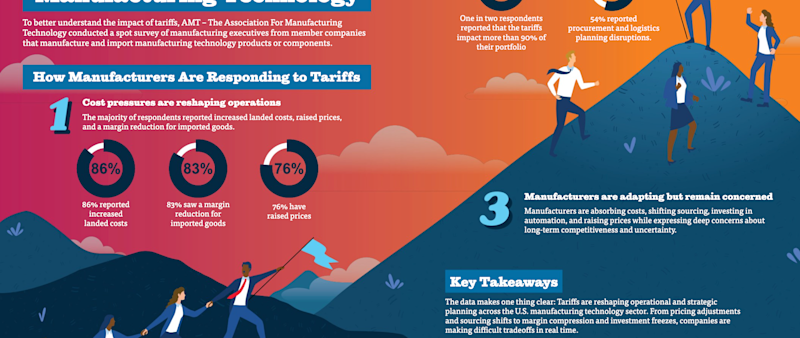

Tariffs, like the new Section 232 tariffs, are reshaping how manufacturers plan, invest, and compete – with consequences that extend well beyond the balance sheet. Here are some important takeaways and insights from AMT’s 2025 Q3 Spot Survey.

AMT Vice President – Technology Ryan Kelly and Trade Lawyer and former (USTR) Counsel Patrick Childress discuss how manufacturers can navigate tariffs, stay compliant, and advocate effectively.

As of Sept. 26, 2025, the U.S. Department of Commerce has opened a Notice of Request for Public Comments on the Section 232 National Security Investigation of Imports of Robotics and Industrial Machinery.

The Commerce Department added 407 product categories of steel and aluminum derivatives to items subject to 50% tariffs. Even if your finished machining center’s normal duty rate is modest, Section 232 will add 50% on the metal content.

With the recent announcement of new Section 232 derivative tariffs in Q3, member sentiment shifted sharply. AMT’s latest spot survey reveals a renewed sense of strain, strategic hesitation, and export headwinds across the manufacturing technology sector.

As tariffs remain a top concern across the manufacturing technology industry, AMT surveyed 59 member companies to assess their impact. The data reveals price increases, operational stress, strategic uncertainty, a need for sustained advocacy, and more.

Tariff volatility and global disruptions are reshaping supply chains. Explore how reshoring can reduce risk and what major manufacturers are doing – or considering – in response.

Could reshoring reduce the risk of retaliatory tariffs from China and mitigate geopolitical risks? Explore how U.S. manufacturers can enhance supply chain resilience, safeguard against global conflicts, and capitalize on new business opportunities.